Commercial Property

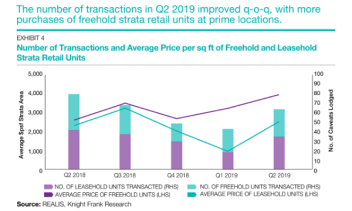

Strata-titled retail units sales skyrocket 105% to $130.6m in Q2: Knight Frank

63 strata-titled retail transactions were lodged in Q2, up 50%.

Strata-titled retail units sales skyrocket 105% to $130.6m in Q2: Knight Frank

63 strata-titled retail transactions were lodged in Q2, up 50%.

Chart of the Day: Auction listings jumped 47.6% to 400 in Q2

Despite higher listing numbers, the success rate continues to go down.

Hongkong Land profit plunged 63% to $565.5m in H1

Net debt rose to US$3.9b due to land acquisitions.

Chart of the Day: Real estate investment sales volume dropped 43% to $13.5b in H1

Transactions for mixed-use properties crashed 90.2%.

CapitaLand Retail China Trust NPI up 7.3% to $40.36m

Rents across its malls grew whilst operating expenses dipped.

Singapore's JustCo leases 16-storey building in Seoul CBD

The 140,000-sqft space will open its doors in November 2019.

Temasek sells joint-owned office asset for $1.6b

Allianz will own 60% of the assets whilst Gaw Capital will hold the remaining 40%.

Mapletree North Asia Commercial Trust NPI up 10.7% to $85m in Q1

Higher rental incomes from Festival Walk, Gateway Plaza and Sandhill Plaza boosted revenue.

Chart of the Day: Warehouse rents down 1.5% in Q2

Rents for first-storey and upper-storey multi-user factories also slipped 0.5%.

CapitaLand's Raffles City Chongqing achieves 95% retail leasing rate ahead of September launch

Adidas Sportswear Collective, Haidilao hotpot and Charles & Keith will open its stores in the mall.

Top office REITs averaged 19.6% YTD return

Mapletree Commercial Trust was the strongest performer with YTD total returns of 28.6%.

Frasers Logistics & Industrial Trust's NPI climbed 24.4% to $46.3m in Q3

Acquisitions in Australia and Europe pushed income up.

Chart of the Day: Office property investments nearly doubled to $1.9b in Q2

It outgrew the residential segment where investments plummeted to $914.2m.

Mapletree Industrial Trust eyes international buys to boost overseas AUM to 30%

It could enter third party deals in Europe and Asia to drive DPU growth.

Office prices climbed 0.9% in Q2: URA

Rentals of office space also rose 1.3% in the same period.

Mapletree Commercial Trust's NPI inched up 2.8% to $88.35m in Q1

All properties except Mapletree Anson performed strongly in terms of contributions.

Suntec REIT's NPI down 7.4% to $114.56m in H1

Sinking fund contribution for Suntec City Office’s upgrades worth $8m hit earnings.

Advertise

Advertise