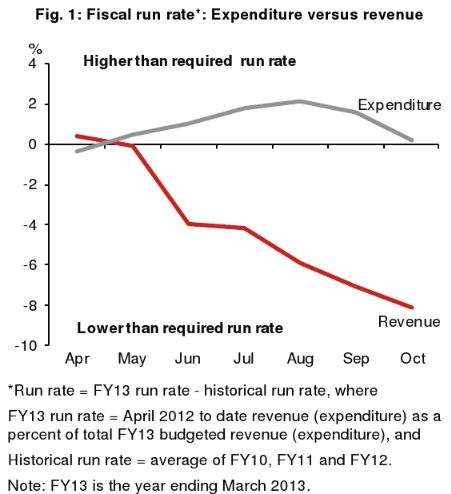

This chart shows how disastrous India's revenue collection is

Revenue is just 42% amid slash on spending.

According to Nomura, the government is cutting back on spending. After growing near 20% y-o-y during Apr-Aug, government spending rose only 2.9% y-o-y during Sep-Oct, owing to slower defense and capital expenditure and delayed subsidy payments to oil companies.

Here's more from Nomura:

The government aims to further slice plan and non-plan expenditure.

Even though expenditure growth has moderated, revenue collection is lagging behind budget targets.

Revenue collection during Apr-Oct totaled just 42% of the FY13 budget target, compared with an historical average of 50% (or 8 percentage points behind the required run rate).

Sluggish economic growth has hurt tax buoyancy, while receipts from asset sales (disinvestment and the telecom spectrum auction) have been lackluster thus far.

Therefore, although purse strings are being tightened, we expect a fiscal deficit of 5.8% of GDP in FY13, higher than the government target of 5.3%, as revenue continues to be disappointing.

Advertise

Advertise