Check out this 'lazy man's model' of Japan's inflation pressure

Is the 2% inflation achievable?

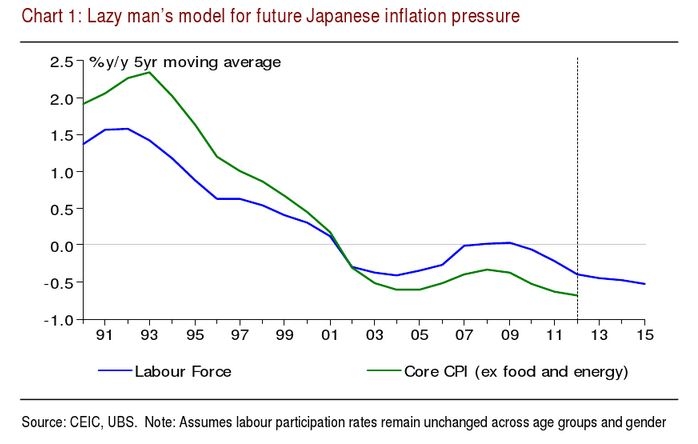

According to UBS Investment Research, the easiest way to forecast Japanese inflation over the past two decades has been to project growth in the labour force. Achieving a sustained and healthy 2% inflation rate for Japan is synonymous with saying aggregate demand will exceed aggregate supply.

A rapidly growing labour force makes it easier to generate demand from several perspectives. For starters labour supply growth is correlated with aggregate income growth for households.

Here's more from UBS Investment Research:

That logically affects aggregate demand; hence, a contracting labour supply makes it difficult to raise potential GDP and aggregate demand in the years ahead regardless of the BoJ’s policy if this continues.

Japan’s labour supply is a function of population growth and different labour participation rates across gender and age groups. Population is shrinking and will continue to fall in the years ahead.

That is a near certainty in the absence of immigration. Hence, Japan’s labour participation rate needs to rise to compensate for a shrinking population.

That’s seems unlikely, though. Japan is aging rapidly and the labour participation rate falls for people as they grow old. Conceptually the impact of aging on the labour participation rate might be offset by a rising participation rate for women, but they are also aging.

The overall female labour participation rate for Japan was 48.2% in 2012 (not far from the OECD average) and for women aged 15-64 the participation rate was 63.4%.

This latter segment of the female population is where the bulk of a rise would need to come from and even if you assume optimistically that the participation rate for this group rises a full percent each year through 2015 the labour force would still contract.

Chart below shows the outlook for labour force growth under more realistic assumptions; i.e., holding labour participation rates steady for gender and age. If the historical relationship in Chart 1 holds then achieving a sustained 2% inflation is very doubtful.

Advertise

Advertise