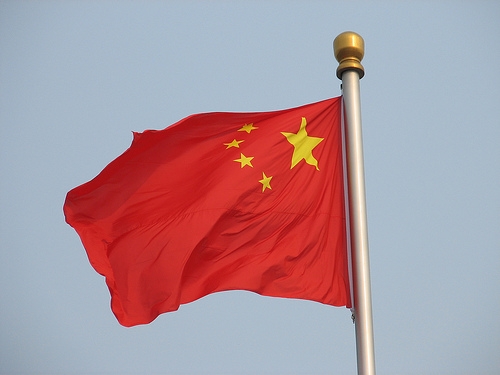

China under threat from extend-and-pretend approach to debt

Local government debt stands at 32% of the GDP.

The Chinese government’s directives last week concerning local government debt signal a potentially significant policy shift to prioritise growth over managing the country's debt problem, says Fitch Ratings.

Fitch stated that uncertainty over the scale and strategy to resolve high local government debt remains a key issue for China's sovereign credit profile, and the latest directives could reflect a continuation of an "extend and pretend" approach to the issue.

A joint directive from the Chinese finance ministry, central bank and financial regulator on 15 May, instructed the banks to continue extending loans to local government financing vehicles (LGFV)s for existing projects that had commenced prior to end-2014, and to renegotiate debt where necessary to ensure project completion.

“This is an explicit form of regulatory forbearance, and serves to delay plans to wind down the role of LGFVs. More broadly, it also suggests that propping up growth in the short term has temporarily taken priority over efforts to resolve solvency problems at the local government level,” Fitch noted.

Fitch estimates local government debt to have reached 32% of GDP at end-2014, up from 18% at end-2008. The CNY14.9trn increase accounts for 18% of the rise in total debt.

Advertise

Advertise