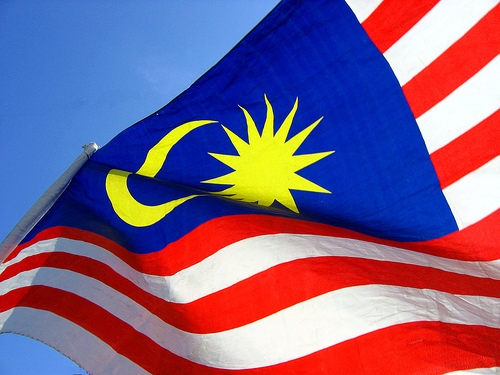

Malaysia's inflation seen to spike up to 2.5%

Blame it on fuel subsidy cuts.

According to DBS, Malaysia's inflation reading for Sep13 will likely spike up on the back of the recent fuel subsidy cuts. A forecast of 2.5% YoY has been penciled into our forecast and this is up significantly from 1.9% in the previous month.

Here's more from DBS:

To rein in a deteriorating fiscal balance, the government cut both Ron 95 petrol and diesel subsidies by MYR 0.20 per litre.

This will raise the pump prices for RON95 petrol to MYR 2.10/litre and diesel to MYR 2.00/litre after the hike, up from MYR 1.90 and MYR 1.80 respectively.

This latest move is expected to save about MYR 3.3bn per year as part of the crucial budget reforms. But the inflationary effect will surely be manifested in the headline inflation number.

In fact, there is upside risk to September inflation. Opportunistic pricing behavior by retailers to capitalise on the hikes in fuel prices as well as a weaker currency, which could stoke higher imported inflation will likely put further upward pressure on domestic prices.

Note the ringgit has depreciated about 5.6% compared to the same period last year.

Indeed, inflation is rising while growth is slowing. The days of strong growth, low inflation is coming to an end. This is the price to pay in reining in the fiscal deficit. A process that is necessary to bring about longer term fiscal sustainability and economic stability.

Advertise

Advertise