SEA may lose business appeal as minimum wage skyrockets 82% in 2019

To mitigate cost impact, firms could embrace AI or start operations in Africa or South Asia.

East and Southeast Asian countries are expected to lose their competitive edge over the next decade due to the rapid rise in minimum wages across the region as businesses face increasingly higher costs of production, according to a report by Fitch Solutions.

The average minimum wage in the East and Southeast Asia region was only around 63% of the global average in 2015, but it has risen to nearly 82% in 2019, and is projected to catch up with the global average or, even worse, overtake it by the end of the next 10-year period.

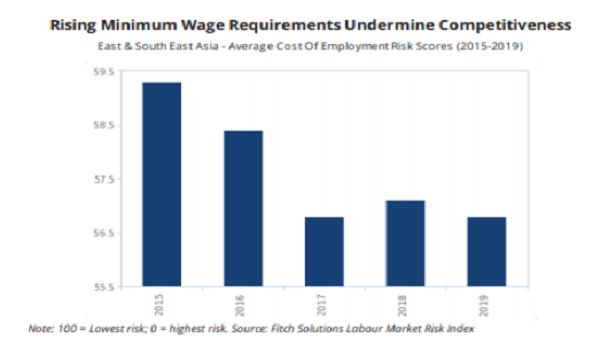

Consequently, the region’s average “Cost Of Employment” score in Fitch Solutions’ Labour Market Risk Index has decreased to 56.8 out of 100, down from 59.3 in 2018, indicating the gradually increasing labour cost risks for businesses in the region.

The availability of large pools of low-cost labour had previously positioned East and Southeast Asia as the premier hub for labour-intensive business operations, particularly in manufacturing. This model had also supported rapid economic growth in countries such as China, Malaysia and Thailand over the past five decades. However, the across-the-board rise in minimum wages in the region is increasingly raising the cost burdens for companies as the region transitions to high-value manufacturing and service-based economies and away from agriculture and low-cost labour-intensive sector.

“This, together with robust economic growth and the rising costs of living, risks exacerbating regional wealth inequality, thereby emboldening workers’ demands for higher minimum wages. Meanwhile, authorities in some countries, including Cambodia, Vietnam and the Philippines, are succumbing to worker and union demands in order to prevent possible outbreaks of social unrest that could cause political instability,” Fitch Solutions said.

South Korea, Hong Kong and Taiwan have the highest minimum wages in the region, at $1,101.6, $886.3 and $722.7, respectively. By contrast, Laos, China and Vietnam saw the largest YoY average growth rates of 14.6%, 9.8% and 8.8%, respectively, between 2015 and 2019.

“With effect from January 2019, Malaysia introduced a nationwide standardised minimum wage of about $250.9 (MYR1,050), up from $248 (MYR1,000) in Peninsular Malaysia and $228 (MYR920) in Sarawak, Sabah and Labuan,” Fitch Solutions highlighted.

Meanwhile in Vietnam, the 2019 minimum wage also increased by an average of 5.3% across its four regions, with Region 1 (covering the urban areas of Hanoi and Ho Chi Minh City) seeing the largest increase of 5.9% at $180.

According to Fitch Solutions, to maintain their medium-to-long term competitiveness, labour-intensive businesses in the region, such as those in the low-value manufacturing segments, will need to find production alternatives. This could entail the use of artificial intelligence (AI) and automating more aspects of production or moving workers further up the manufacturing value chain into more knowledge-driven industries.

“These alternatives come with the additional risk of increasing other business costs, such as expenditure on research and development (R&D), retraining workers and/or importing skilled talent from abroad for highly skilled roles. Alternatively, firms can start to consider setting up their low-cost operations in other destinations, such as Sub-Saharan Africa and South Asia, that still offer relatively low labour costs by global comparison,” Fitch Solutions commented.

Advertise

Advertise