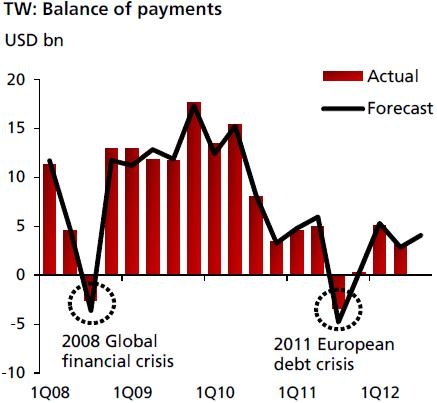

Taiwan's BOP surplus forecast to have widened

Thanks partly to the recovery in foreign investment in the TAIEX market.

DBS Group Research noted:

The balance of payments data for 3Q will be released today. The net BOP surplus is expected to have widened to USD 4bn from USD 3.1bn in the previous quarter. The increase in net capital inflows should largely come from the expansion in trade surplus, and the recovery in foreign investment in the TAIEX market.

Partly offsetting these rises should be outward portfolio investment, and a modest decline in the services account surplus due to the seasonal slowdown in tourist arrivals. We expect the trade and equity inflows will continue to bolster the BOP surplus in the coming quarters.

Given Taiwan's close trade and economic connections with China, a recovery in the Chinese economy will directly boost Taiwan's exports, services exports and the outlook of corporate earnings.

Export growth (YoY) has already returned to the positive territory in September-October. Export orders for October (due today) are expected to continue to improve modestly from the preceding month (DBSf: 2.0% YoY, vs. 1.9% in September).

That said, risk appetite remains fragile in the global financial markets and portfolio capital flows would remain volatile, due to the upcoming US fiscal cliff and lingering risks in Europe.

Advertise

Advertise