Thailand figures still point to weak external demand

Export components have yet to show signs of a turnaround.

DBS Group Research noted:

The trade and industrial production data in recent months still point to weak external demand, the surprise 0.2% YoY export increase in September notwithstanding.

In particular, there was a 98% MoM surge in the jewelry component that skewed exports to the upside. Jewelry exports tend to be volatile and a reversion to trend is to be expected in October.

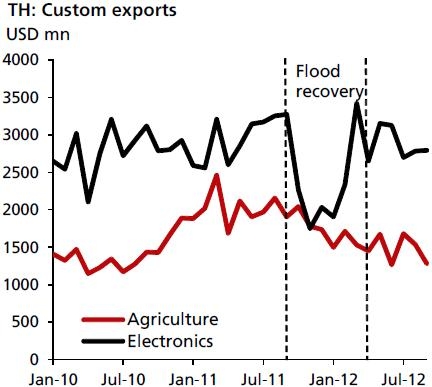

Aside from vehicles and metal manufacturing, many of the other export components (including agriculture, electronic goods and electrical appliances) have yet to show signs of a turnaround.

Notably, industrial production growth has been in negative territory since July and the import of raw materials has also slid in level terms over the last two months.

Headline export and import growth (due in the coming days) is expected to reach 20.6% YoY and 10.2% YoY respectively in October.

However, this is largely on account of the low base effect due to the flood in 4Q last year. On a sequential basis, we are expecting exports to fall by 2% MoM and imports to increase by 1.5% MoM.

Advertise

Advertise