US retailers to rely on Vietnam amidst exits from China's textile industry

Vietnam’s textile sourcing rose 13% YoY in Q1 2019.

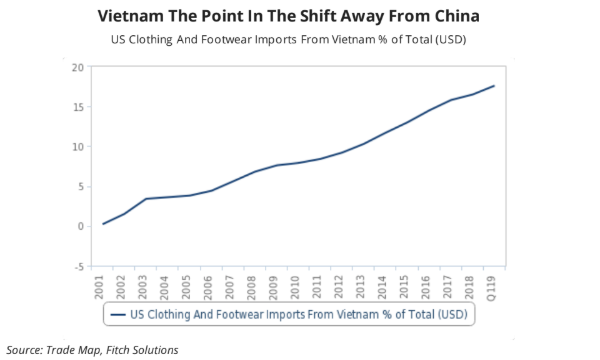

Vietnam is expected to benefit the most from plans by US retailers to diversify production to other manufacturing hubs and reduce reliance on China for their textile needs, according to a Fitch Solutions report.

The US-China Trade War has accelerated the steady decline in apparel imports to the US from China, with a drop of 1% YoY at 34.5% of the total market share on Q1 2019. Major US fashion retailers may further decrease their supply-chain exposure to China after president Donald Trump announced a 10% tariff hike on US$300b worth of Chinese imports on 1 September.

Vietnam is expected to cash in from heightening tensions between the two economic superpowers, having seen textile sourcing rise by 13% YoY at 17.6% of total market shares on Q1 2019.

The country has the second most number of clothing and footwear imports to the US, at 16.5% in 2018 compared to 0.2% in 2001. The country also offers comparably cheaper labor, with a minimum wage of US$160.7 per month in 2017 compared to China’s US$311.5.

On its part, athletic wear firm Under Armour has expressed plans to decrease its products sourced from China from 18% in 2018 to 7% in 2023, whilst fashion retailer GAP has shrunk its sourcing from 25% in 2016 to 21% in 2019.

US textile imports from China has decreased to just over a third (38%) of the total market share this year from almost half (48%) in 2010, mainly due to rising wages in the latter when there are other major textile producing countries with cheaper labor costs.

Fitch Solutions adds that Indonesia, Bangladesh, India, Cambodia, Nicaragua, Jordan, Haiti and Egypt may also benefit from the diversification of US retailers.

Advertise

Advertise