What you need to know about Malaysia REER

Improvement from export competitiveness is necessary to provide some support for the economy.

DBS Group Research noted:

A poor outcome is expected from today's Aug12 trade data. Export sales are likely to have contracted further by 2.7% YoY, following an already dismal reading of -1.9% in the previous month. Imports are expected to grow by 13.4% on account of the strong domestic investment and consumption demands. That implies another sub-par trade surplus of MYR 3.0bn in the month, a further decline from an already poor outcome of MYR 3.6bn previously.

Malaysia's trade performance in recent months bears witness to the dire conditions in the global environment. External demand has turned increasingly weaker as growth outlook in the developed economies turned dimmer. This largely explains the poor export performance and Malaysia is definitely not alone in this regards.

Yet, trade and current account surpluses are shrinking rapidly as import growth continues to surge ahead. Strong domestic demand on the back of a healthy pipeline of developmental projects and buoyant domestic labour market are driving import growth on top of the healthy private consumption and investment growth.

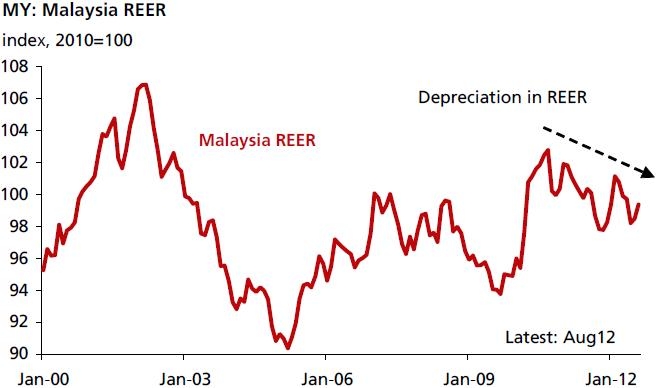

The drastic declines in the trade and current account balances call for a more competitiveness currency. This explains why the strength of the ringgit has to remain benign compared to the regional peers such as the Sing dollar. Improvement from its export competitiveness, as seen in its REER depreciation, is necessary to provide some support for the economy amid the strong external headwinds.

Advertise

Advertise