Double-digit GDP contraction imminent in Q2: analyst

Labour conditions are also slated to get worse, even after Q2.

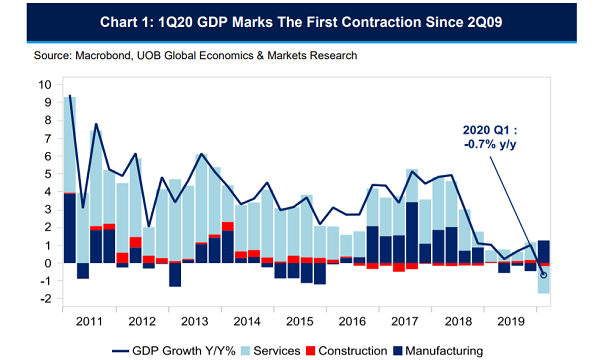

Singapore may see its Q2 gross domestic product (GDP) crash 10.5% YoY and 34.6% QoQ given that circuit breaker measures were in place during most of the period, according to an analyst note by UOB. This could also mark the first technical recession since Q1 2009, when the GDP contracted 9.9% QoQ basis.

So far, data hinted at a relatively subdued prognosis for Singapore’s growth prospects. As of the latest May data, industrial production disappointed market expectations—which posited a 7.7% YoY expansion—and instead contracted 7.4% YoY (-16.5% MoM), marking its first fall in three months. The purchasing manager's indices (PMI) released by both the Singapore Institute of Purchasing and Materials Management (SIPMM) and IHS Markit in the same month also highlighted headwinds against Singapore’s manufacturing environment.

Disruptions in the supply chain and negative demand shocks in H1 also gave the economy no respite. Singapore’s NODX fell 4.5% YoY in May, the first time in four months, as the decline in non-electronic exports outweighed the gains in electronic exports. Total trade also continued to contract for the third straight month by 25% YoY.

In addition, retail sales plunged by another 52.1% YoY in May, a record pace of contraction since data was made public in 1985, that even the spiked demand for online shopping and e-commerce (+125.6% YoY) were not able to counter the overall fall in retail demand. Many retail outlets and departmental stores stayed closed during this period.

Labour conditions did not fare well as the Ministry of Manpower stated that the overall unemployment rate rose to 2.4% in Q1.

“We note that the uncertainty surrounding the length and severity of COVID-19, as well as the emergence of renewed US-China tensions continue to cloud Singapore’s trade prospects,” said Barnabas Gan, economist at UOB. “Collectively, the quick deterioration of economic prospects both globally and domestically is expected to weaken Singapore’s labour market.”

As a result, Gan is expecting the unemployment rate to widen by 3.5% in 2020, with upside risks should the COVID-19 pandemic be more severe and protracted. As for consumer prices, Singapore may still be in deflation by Q2, but pressures on prices may gradually dissipate in H2 thanks to the Phase 2 reopening.

Moderate contraction ahead

Following Q2, Gan projected that the GDP decline in Q3 and Q4 will ease to -3.7% YoY and -1.2% YoY respectively. However, he noted that Singapore’s output gap to-date remains in negative territory, suggesting that the economy is still growing below potential.

“Being a small and open economy, the city-state will be largely susceptible to the fall in global demand. The deterioration of global economic activity, in turn, could continue to weigh on Singapore’s trade-oriented industries such as the wholesale trade, transportation & storage, and manufacturing,” Gan warned.

Further, the Lion City’s reopening remains gradual and cautious, which will then spill over to domestic consumption and the retail trade sector. Sectors that rely on foreign manpower such as construction and marine & offshore engineering may also continue to experience manpower shortages due to the ongoing pandemic amongst migrant workers.

Singapore’s tourism sector may still be in the doldrums for the rest of 2020. Even as the opening of tourist attractions from 1 July is welcome news for both local consumers and establishments, a sustainable and robust recovery for tourism-related industries will still be dependent on the opening of Singapore’s borders to international visitors.

“Moreover, with the Formula One races cancelled in Singapore, any hopes for a potential Q3 increase in tourism is effectively out of the window, and an uptick in tourism activities will depend on travel green lanes that may be announced in the foreseeable future,” Gan said.

As for labour conditions, things are still expected to get worse. Gan noted that Singapore’s unemployment rates also increased significantly in past crises in 1998, 2001, 2003 and 2009, compared with the peak levels of the prior four quarters in the respective periods. “For 2020, we pencil the unemployment rate to rise to 3.5%,” he added.

However, pharmaceutical production and exports may be a boon for Singapore’s overall manufacturing and trade environment. “The increased demand for medical goods during the COVID-19 pandemic may be the lynchpin of growth for Singapore’s non-electronic NODX, and in turn, biomedical manufacturing,” Gan said.

Advertise

Advertise