Economic tailwinds to drive Singapore's growth in 2020

NODX is tipped to recover to 1.6%.

Singapore’s economy is projected to grow at 0.5% in 2019 and will accelerate further to 1.5% in 2020, according to UOB Global Economics and Markets Research. It also cited the Monetary Authority of Singapore’s (MAS) survey that market analysts have upgraded their GDP growth outlook to a median estimate of 0.7% YoY for 2019, from 0.6% made in September.

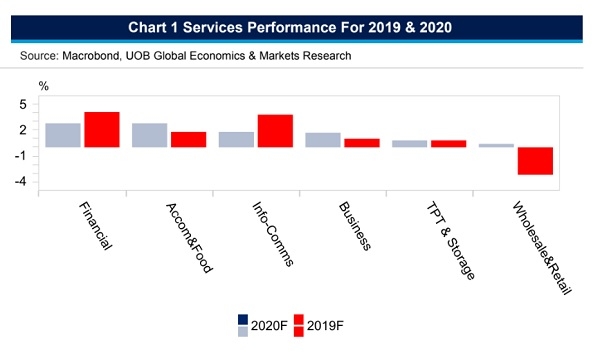

UOB cited three key drivers that informed the analysts’ bullish outlook on the island’s economy for the next year. Firstly, the services sector is expected to continue driving Singapore’s growth into 2020, supported by the finance & insurance and accommodation & food services clusters, which are expected to grow 3.5% and 2% YoY, respectively.

The wholesale & retail trade sector is also expected to slightly recover to 0.4% YoY over the same period.

The second key driver is the manufacturing sector, which is said to have been the key drag to overall growth in 2019, but is expected to recover into 2020 by expanding 0.7%. Singapore’s industrial production growth clocked positive growth prints in September (0.7%) and October (4%), surprising market expectations. To-date, the contraction of semiconductor sales out from Asia-Pacific has also moderated.

Also read: PMI rose 0.2 points to 49.8 in November

Thirdly, UOB noted that the expected improvement in the global economic backdrop could give Singapore’s export the necessary fillip for 2020. Singapore’s non-oil domestic exports (NODX) may likely contract 9.1% YoY in 2019, but is expected to recover to 1.6% in 2020.

“Our estimates show that while electronic exports could remain in contraction zone (2020: -3.2%, up from an estimate of -21.0% in 2019), non-electronic export growth is expected to expand by 2.4% in 2020 (2019 estimate: -4.7%), led by healthy shipments of pharmaceutical products, chemicals, and electrical circuit Apparatus,” economist Barnabas Gan said.

In addition, consumer prices are tipped to accelerate to 0.9% in 2020, up from the estimated 0.7% in 2019, to be driven by Education (2.6%), Food (2.2%) and Healthcare (1.7%), in line with the observations from the first ten months of 2019. Core inflation is however expected to stay unchanged at 1.2% for 2019 and 2020.

Consumer prices are also expected to be driven by falling electricity prices, the reduction in the services dependency service ratio (DRC) from 40% to 38% starting January 2020, and official expectations for the dissipation of negative contribution of imputed rentals to headline inflation in 2020.

Advertise

Advertise