GDP to decline 6% in 2020: survey

The economy shrunk faster than expected in Q2.

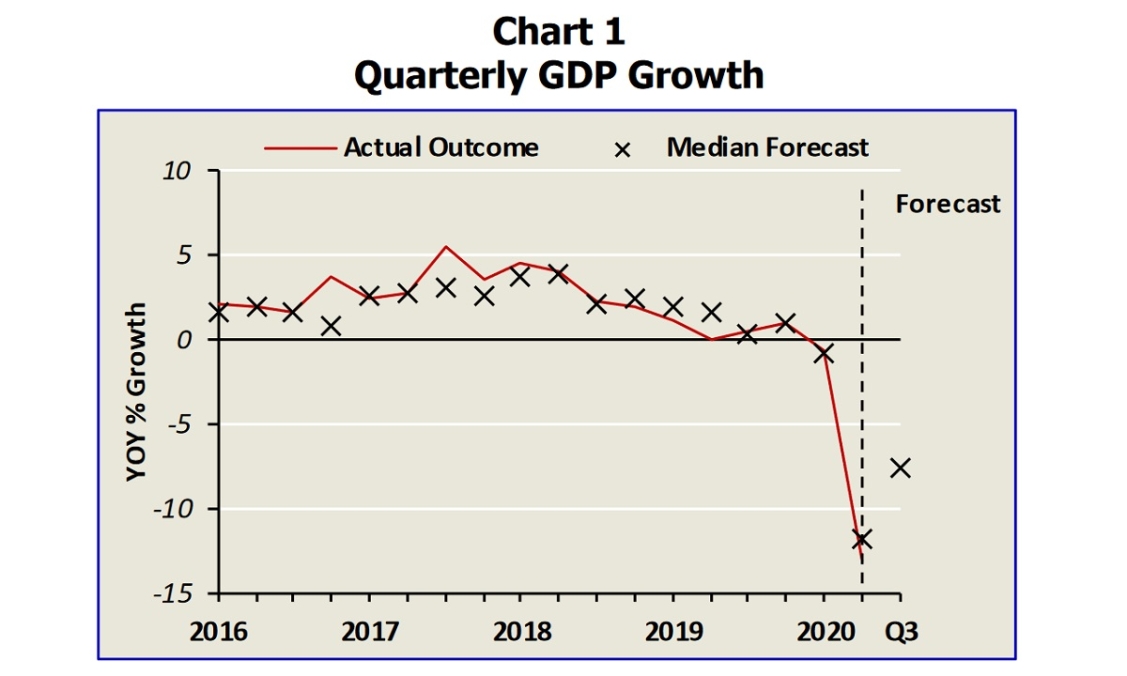

Singapore’s gross domestic product (GDP) is now expected to decline 6% in 2020, according to the latest Monetary Authority of Singapore’s (MAS) survey of professional forecasters. This is lower from the 5.8% fall estimated in the June survey.

The economy shrunk by 13.2% in Q2 compared with the same period last year, larger than the respondents’ forecast of an 11.8% decline in the previous survey. For Q3, respondents—which consist of 28 economists and analysts—expect the economy to contract by 7.6% YoY.

Based on the survey’s mean probability distribution, the most likely outcome is for the economy to shrink by 5.1 to 7.1% in 2020. This accelerated from the earlier estimates of -6% to -4.1%.

Meanwhile, prices are expected to deflate 0.6% to 0.4% in Q3, according to the CPI All-Items inflation and the MAS Core Inflation, respectively. Respondents project that CPI-All Items inflation will most likely fall in the range of -0.5 to -0.1% in 2020, as will the MAS Core Inflation.

As for the labour market, respondents expect the unemployment rate to reach 3.5% in the year-end, marginally lower than the 3.6% in the June survey.

On the upside, GDP growth is expected to recover to 5.5% for the whole of 2021. The respondents estimate that the economy is most likely to grow by 4% to 5.9% next year.

Meanwhile, CPI-All Items inflation and the MAS Core Inflation are expected to come at 0.7% in 2020.

Profits, prices

For Q3, all respondents who provided MAS inputs expect lower corporate profitability compared to the same period in 2019. Meanwhile, two-thirds of the respondents expect that private residential property prices will decline further compared to Q2, whilst 22.2% expect prices to remain stable. Only 11.1% expect an increase.

Half of the respondents project that SGD corporate bond spreads willremain stable, 25% expect them to rise, and the remaining25% forecast a decline.

For the whole of 2020, all respondents expect corporate profitability to decline. More than half believe private residential property prices will decline, whilst 50%project that SGD corporate bond spreads will remain stable.

On a brigther note, respondents predict an improvement in corporate profitability for 2021, with 88.9% expecting an increase. Meanwhile, 44.4% expect private residential property prices to rise in 2021, and half of the respondents project that bond spreads will fall.

Advertise

Advertise