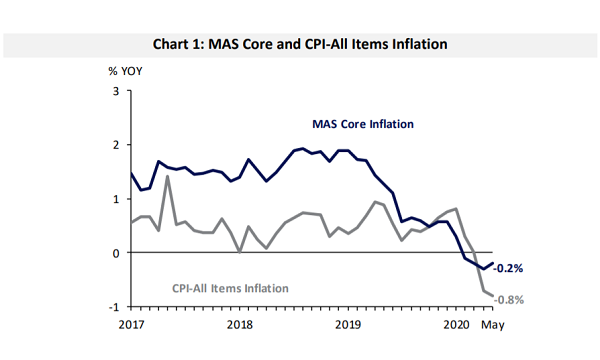

Inflation down 0.2% in May

CPI‐All Items inflation also fell no thanks to a larger decline in private transport costs.

MAS Core Inflation is still in the red as it dipped 0.2% YoY in May, albeit a relaxed decline compared to the ‐0.3% in April, according to data from the Department of Statistics (SingStat). This was largely due to smaller declines in the costs of services and electricity, as well as higher food inflation.

"Core CPI slipped for the fourth consecutive month by 0.2% yoy in May, which is likely to keep MAS cautious in the near-term, albeit this is marginally less than the -0.3% yoy seen in April due to smaller declines in services and electricity costs as well as higher food inflation. Given that domestic demand may only gradually recover with the transition to Phase 2 on 19 June amidst a softening labour market, we may not see a quick bounce back into positive territory anytime soon," said Selena Ling, head of treasury research & strategy at OCBC.

Ling noted that during the 2009 Global Financial Crisis, core inflation slid for nine straight months from May 2009 to January 2010. As a result, it could be highly plausible to see disinflation to extend for the short-term even though crude oil prices have escaped their lows.

Meanwhile, CPI‐All Items inflation fell 0.8% YoY in May, no thanks to a larger decline in private transport costs.

Private transport costs slipped more steeply, primarily due to a larger drop in car and petrol prices. The continued suspension of electronic road pricing (ERP) charges also lowered private transport costs. The cost of retail and other goods also slid, attributed to steep declines in the prices of clothing and footwear, medical products and household durables. Inflation in personal care products turned negative as well.

On the other hand, accommodation inflation remained flat as housing rents rose at a steady pace.

The pace of decline in the cost of electricity and gas eased in May as new subscriptions under the Open Electricity Market (OEM) stagnated. Food inflation edged up due to a larger jump in the prices of non‐cooked food items, whilst services costs fell at a more gradual pace due to smaller declines in holiday expenses and air fares.

"For food items, eggs, meat, rice, pork, oils, seafood, bread and pasta were more expensive, possibly due to global supply chain disruptions amidst the plethora of national lockdowns and cessation of international travel, albeit NTUC recently pledged to freeze prices of 100 daily essentials house brand items till end of 2020," Ling noted.

She is expecting disinflation to continue into June and beyond, which may extend till the end of 2020. "Whilst there may be some pent-up demand translating into an initial rush of enthusiasm for retail purchases and eating out in the very near-term, the key is if the momentum would sustain into H2, especially since the medium-term picture remains one of subdued labour market conditions and general market caution over second infection waves which may cap domestic demand, especially for discretionary items," Ling added

Advertise

Advertise