Inflation hits three-year low in July

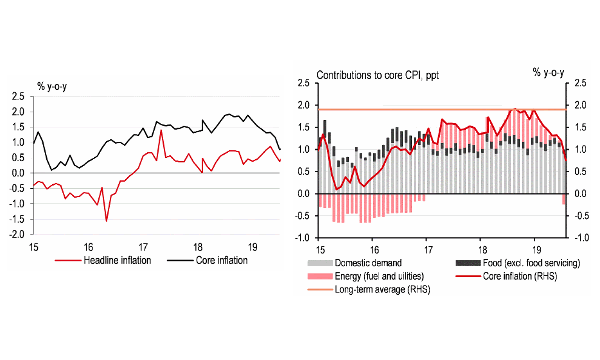

Core inflation eased to 0.8% YoY mainly due to cheaper energy prices.

Singapore’s headline inflation moderated to 0.4% YoY in July 2019, mainly driven accommodation costs that have continued their decline both in YoY and MoM terms. Private sector transportation costs remained almost flat, up only 0.3% YoY.

Core inflation, excluding accommodation and private road transport, eased to 0.8% YoY, largely thanks to lower energy prices. In particular, electricity rates plunged 7.0% YoY, as a result of a much smaller YoY increase in regulated tariff in Q3 and the ongoing liberalization efforts in the electricity sector.

The Monetary Authority of Singapore (MAS) maintained its core inflation forecast range for 2019 at 1-2% YoY but now expects core inflation to come in within the lower end of the range.

The moderation was widely expected, said HSBC economist Yun Liu. “The drags came from a confluence of factors. One is the lower private sector transportation costs, declining 0.2% MoM, mainly reflecting lower Certificate of Entitlement (CoE) premiums. That said, CoE prices are likely to rise in August-October following a 17.8% QoQ cut in COE quotas set by Singapore's Land Transport Authority, putting some upward pressures to headline inflation for the coming months.”

Also read: Inflation down to 1.2% in June

UOB economist Barnabas Gan also noted that there were several other policy-induced factors which further contributed to the disinflationary environment. “Firstly, there were two rounds of water price increases in July 2017 and July 2018 which led to the rise of the cost of water supply then, this high base effect has dissipated by July 2019,” he said.

There were also Services & Conservancy Charges (S&CC) rebates given to HDB households in July 2019, which effectively dampened accommodation costs, Gan added.

Liu also noted that energy prices made negative contributions to the core for the first time since 2017. “This largely reflected a much smaller increase in regulated tariff in 3Q compared to a year ago (2.4% v.s. 14.1% YoY). Meanwhile, the dampening effect of the Open Electricity Market (OEM) continues to be felt,” she said.

“Although electricity tariffs are set to increase by 6.3% QoQ in July-September, fuel and utility costs only rose 2.1%. This likely suggested that more customers are switching to cheaper plans provided by other electricity retailers,” Liu added.

RHB Research said in a note that the softening of core inflation to multi-year lows highlights further evidence of a weakening economy. “This may prompt the MAS to ease the monetary policy in the October meeting,” the team said.

Liu concurred and said that weak core inflation, along with declaration in growth, call for the needs of policy stimulus. “This becomes even more pressing, particularly after the slowest growth (0.1% YoY) in a decade seen in Q2. We expect the MAS to ease its monetary policy in the October policy meeting with a 50bp reduction to the SGDNEER policy slope,” she added.

Advertise

Advertise