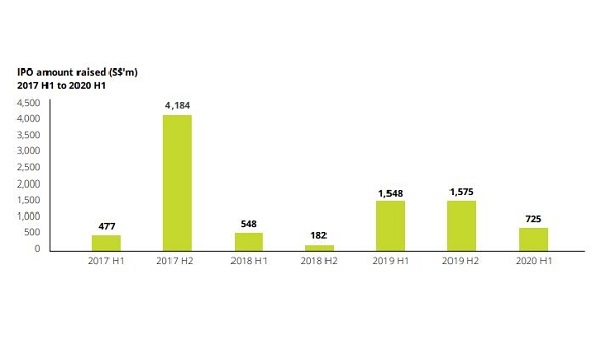

IPO fundraising plunged 53.2% to $725m in H1

IPO momentum was interrupted by the pandemic and circuit breaker.

Singapore’s initial public offering (IPO) activity registered a 53.2% drop in funds raised in H1 with $725.04m in proceeds raised and an IPO market capitalisation of $1.19b, according to findings in Deloitte’s mid-year review.

The city-state only saw six IPOs in H1, a fall from the nine IPOs with $1.55b proceeds and an IPO market capitalisation of $2.24b in H1 2019.

Five of the six IPO listings took place in Q1 before the pandemic took a heavy toll on the health of the equity market in Q2, a period which saw zero activity during Singapore’s nationwide circuit breaker. The capital market saw one IPO listing after the circuit breaker was lifted.

Despite the pandemic curtailing companies’ listing debut on the Singapore Exchange (SGX), real estate investment trusts (REITs) and business trusts continued to dominate the market, making up 95.2% of total funds raised in H1.

Two REITs were listed on the Mainboard—Elite Commercial REIT and United Hampshire US REIT—raising a combined $690.5m in gross proceeds. This is compared to H1 2019 where there were two REITs that accounted for 96% of total funds raised with $1.5b (US$1.1b) in proceeds as at IPO.

The remaining four IPO listings, all listed on the Catalist, raised a total of $34.6m, with gross amounts ranging from $3m to $19m.

The Singapore bourse also welcomed its first New York Stock Exchange (NYSE)-listed company with a dual-class voting structure on its mainboard, AMTD International Inc. (AMTD), which made its secondary listing debut on SGX’s Mainboard on 8 April.

Upon its secondary listing on the SGX Mainboard, AMTD saw an increase in share price on NYSE by 5.9% to $12.54 (US$9) from $11.84 (US$8.5) on the previous close, a record high in H1 2020.

Deloitte Southeast Asia and Singapore disruptive events assurance leader, Tay Hwee Ling, notes there has been an increase in number of IPOs and amount raised compared to the same periods in prior years; however, this momentum was interrupted by the pandemic and the circuit breaker.

Furthermore, Tay shares that potential issuers continue to seek new capital and IPOs of companies dealing with essential services might emerge as a response to these opportunities thrown up by the pandemic, giving the IPO market a shot in the arm.

“They could also consider other capital raising options in the market such as private fund raising, but before doing so, it is important for companies to do a stocktake on how their assets may be valued in this new normal compared to half a year ago,” she added.

Meanwhile, market volatility will continue to dominate the IPO market for the remainder of the year, though there are companies preparing ahead, exploring IPO readiness support to be geared up for the opportunity to tap into the market.

Tay further notes that there is still appetite for fundraising in the market as they continue to receive enquiries for potential REIT listing and Catalist listing based in the Asia Pacific region. She also expects to see continuing growth for REITs amidst a low interest rate environment, buoyed by new government measures and stimulus packages.

Advertise

Advertise