Negative business outlook eases in Q3: study

The sentiments for most sectors were countered by an uptick in manufacturing and finance.

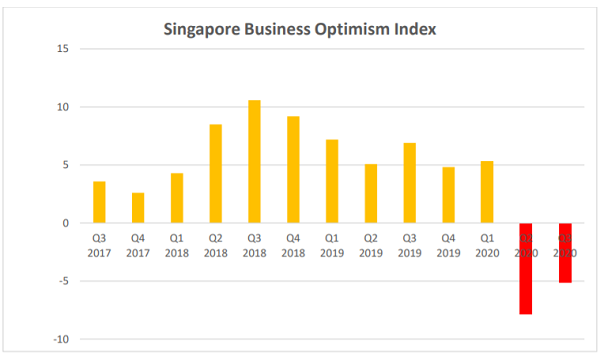

Business sentiment amongst local firms remains downbeat in Q3, even as the business optimism index (BOI) eased to -5.16 percentage points (ppts) from an all-time low of -7.88 ppts in Q2, according to Singapore Commercial Credit Bureau’s (SCCB) Business Optimism Index study.

On a YoY basis, BOI fell significantly from +6.91 ppts in Q3 2019. All six indicators are contractionary for Q3, which include the volume of sales, new orders, inventory levels, employment levels, selling price and net profit.

The construction, services and transportation is the least optimistic, whilst manufacturing and financial sectors have anticipated a slight uptick in sentiments compared to Q2.

Sentiments from the construction sector remained bleak as sales volume worsened from -10 ppts to -20 ppts in Q3. New orders, inventory and employment levels have each fallen from -30 ppts in Q2 to -60 ppts in Q3. Net profit and selling price showed better results but is still in the contractionary zone, up from -30 ppts in the previous quarter to -20 ppts.

In the services sector, volume, net profits, selling price and news orders also remained in contraction but has eased from double-digit figures to single digits over the same period. Employment levels inched up to -3.03 ppts from -3.23 ppts, whilst inventory levels climbed from -29.03 ppts in Q2 2020 to +3.03 ppts.

The outlook for the transportation sector has deteriorated, with volume of sales, net profits and new orders moderating downwards from 0 ppt in Q2 to -30 ppts in Q3. Selling price and employment levels remain unchanged at 0 ppts, whilst inventory levels reversed from +42.86 ppts to -30 ppts over the same period.

The wholesale sector is appearing less weak compared to other sectors mentioned. Its volume of sales and net profit crashed from 0 ppt in Q2 to -17.65 ppts and -5.88 ppts, respectively, in Q3. In contrast, selling price rose from -18.18 ppts and -36.36 ppts in Q2 to 0 ppt in Q3, respectively. New orders remained flat at 0 ppt, whilst inventory levels moderated from +36.36 ppts to +5.88ppts.

The manufacturing sector is in positive territory, with the volume of sales rebounding from -10 ppt to +29.41 ppts, whilst both net profit and selling price rose from -10.0 ppts to 0 ppt. New orders figures also reversed from -10 ppts to +11.76 ppts, whilst inventory levels jumped from -25 ppt to +5.88 ppts. Employment levels also improved from -5 ppts to 0 ppt.

Lastly, sentiments in the financial sector improved slightly as its volume of sales and employment levels jumped from 0 ppt in Q2 to +33.33 ppts in Q3, whilst new orders also inched up from 0 ppt to +66.67 ppts over the same period. However, selling price dived from -16.67 ppts to -100 ppts and net profit fell to 0 ppt from +16.67 ppts. Inventory levels remain unchanged at 0 ppt.

Advertise

Advertise