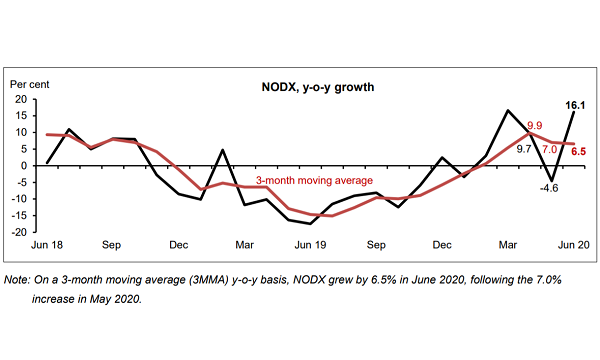

NODX up 16.1% in June

Analysts are now more optimistic on times ahead, but remain wary of a second COVID-19 wave.

Non-oil domestic exports (NODX) jumped 16.1% YoY in June as both electronics and non-electronics NODX grew, according to data from Enterprise Singapore.

On a MoM basis, NODX inched up 0.5% in the same month, following the 4.6% decline in May, as the growth in non-electronic domestic exports outweighed the decline in electronics. The level of NODX hit $14.2b, similar to the previous month.

“The June NODX data suggests that the worst may be over, but do not expect the double-digit NODX growth momentum to be sustained into H2,” warns Selena Ling, head of research and strategy at OCBC Bank.

“The road ahead is yet to be completely smooth sailing as external risks remain, namely with the second COVID-19 waves of infections seen to be slowing down the pace of re-openings in Hong Kong and some US states for example.”

Electronic NODX rose 22.2% YoY in June, thanks to ICs, disk media products and telecommunications equipment as it surged 29.1%, 59.8% and 37.8% YoY respectively, leading the growth in electronic NODX. Barnabas Gan, economist at UOB, stated that these segments underpinned the gains in overall electronic exports.

“However, exports of assembled printed circuit board (PCB) saw four straight months of contraction, with June’s exports falling at its fastest pace since November 2018 at -26.6% YoY,” he added.

Meanwhile, non-electronic NODX also edged up 14.5% YoY. Non-monetary gold (+238%), specialised machinery (+45.9%) and pharmaceuticals (+30.8%) contributed the most to the growth in non-electronic NODX.

“Pharmaceuticals exports remain the silver lining for NODX this year and its share of total NODX has risen to 13% in H1, up from 10% last year. Coupled with electronics exports that contributed 22% of total NODX, these two segments are the mainstay for Singapore’s NODX at this juncture,” Ling noted.

NODX to the top markets as a whole grew in June, though exports to Hong Kong, Indonesia and Thailand dipped. Exports to Japan skyrocketed 94.7% YoY, whilst exports to South Korea and Taiwan also surged 85.6% and 32.6% respectively. NODX to emerging markets crashed 28.8% over the same period, led by South Asia (-39.0%), Latin America (-53.5%) and the Middle East (-18.9%).

Looking ahead, Gan also stated that Singapore’s move to build up its diagnostics, vaccines and therapeutics development, and bolster vaccine manufacturing capacity in H2 are clear evidences for strong biomedical production and export momentum in the foreseeable future.

However, he also notes that the official rhetoric from the Ministry of Trade and Industry (MTI) and the Monetary Authority of Singapore (MAS) have been relatively pessimistic. He cited Trade and Industry Minister Chan Chun Sing who commented that the government is “very concerned that there will be a second wave, if not a third wave or recurring waves of infection across the world, which will cause the demand from these economies to further shrink.”

Likewise, MAS’ managing director Ravi Menon also said that Singapore’s economic conditions remain weak given the COVID-19 pandemic, and roughly 12% of Singapore’s economy is at the “epicentre” of the impact from the COVID-19 pandemic, especially the tourism-related sector.

As for the non-oil re-exports (NORX), figures inched up 5.5% YoY in June. Electronic NORX expanded 21% YoY due to ICs (+22.1%), diodes & transistors (+39.8%) and telecommunications equipment (+19.5%), whilst non-electronic NORX slipped 8.4% YoY due to piston engines (-74.8%), aircraft parts (-32.6%) and alcoholic beverages (-37.8%).

NORX to the majority of the top 10 markets rose, except for Japan and the US. The top three contributors to the increase in NORX were Hong Kong (+22.6%), the EU 27 (+40.9%) and Vietnam (+29.4%).

“The gain in NORX can also be attributed to a low base effect back in June 2019, where 40% of the decline in NORX (or $0.2b of the $0.6b decline in overall NORX) was led by the fall in electronic NORX,” Gan said.

Oil domestic exports fell 60.8% YoY amidst lower oil prices, but has relaxed compared to the 76.2% contraction seen in May. Lower exports to Malaysia (-61.5%), Indonesia (-71.0%) and the EU 27 (-92.7%) contributed to the YoY dip of oil domestic exports. In volume terms, oil domestic exports crashed 38.2% YoY.

Further, the non-oil retained imports of intermediate goods (NORI) slid $0.3b YoY from $6.5b in May to $6.2b in June. Total trade also slipped 6.6% YoY over the same period, easing from the 25% contraction in the preceding month. Total exports fell 3.6% YoY, whilst imports slid 9.9% YoY.

Advertise

Advertise