NODX outlook remains dim despite March surge

Gold might not have enough glitter to carry Singapore’s export growth.

Despite the unexpected rise in non-oil domestic exports (NODX) by 17.6% in March, the outlook for exports for the whole year remains dim amidst global economic slowdown due to the pandemic, according to analyst reports.

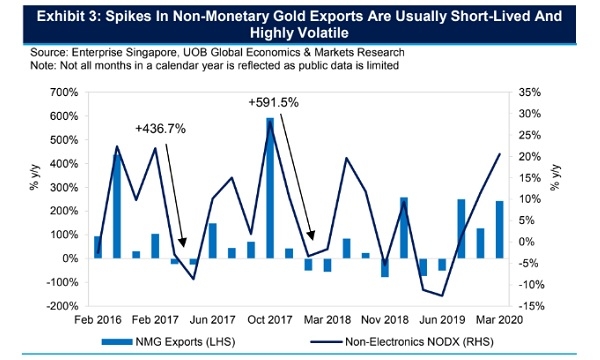

In a note, UOB explained that the factors that led to the positive growth in March may be transient in nature, as it is uncertain if non-monetary gold (NMG) exports, which boosted NODX for the month, can continue to buoy Singapore's external trade for long.

As a reference, NMG exports surged fourfold in May 2016, which may have been likely led by safe haven demand in gold, given Brexit concerns. However, non-electronic exports thereafter contracted for five straight months between June and October 2016, which suggested that the spike in gold export was short-lived and highly volatile.

Further, exports into the coming months may see little reprieve due to supply chain disruptions and negative demand shocks. The recovery in semiconductor exports in February was noted to be too weak. Any fall in demand in electronic exports can easily tip global semiconductor exports to contract in the following year.

Maybank Kim Eng also reported that most major economies are still in lockdown in early Q2, and global demand may enter into a free fall in April and May, which will significantly impact trade.

Still, manufacturing and goods exports may not face as severe a collapse as retail, hospitality, business services, F&B and travel, as they are largely considered to be essential services.

NODX surprised with a jump in March despite disruptions from COVID-19, boosted by a surge in non-monetary gold and an uptick in electronics boosted growth. This was also helped by a low base last year due to the trade war.

“Global electronics demand may be more resilient than other products such as garments, autos or luxury goods, as lockdowns and working from home are increasing orders for tech equipment and entertainment gadgets,” Maybank Kim Eng analysts Chua Hak Bin and Lee Ju Ye said.

Advertise

Advertise