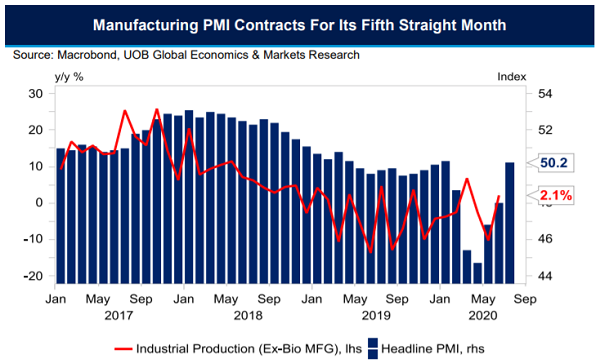

PMI expands to 50.2 in July after months of contraction: SIPMM

Sub-index performances also pointed to an improved external environment.

Following five consecutive months of contraction, the Purchasing Managers’ Index (PMI) reversed to 50.2 in July from 48.0 in June, according to the Singapore Institute of Purchasing & Materials Management (SIPMM).

In an analyst note by UOB’s economist Barnabas Gan, the sub-index performances also pointed to a relatively rosier external environment and manufacturing momentum in July. Headline PMI rose as new exports added 3.3 points to 50.5 in July, whilst factory output added 4.1 points to 50.2 in the same month, the highest since January 2020 at 50.6.

The expansion in Singapore’s new exports coincided with the latest NODX figures, which jumped 16.1% YoY, led by a growth in both electronic exports (22.2% YoY) and non-electronic exports (14.5% YoY), Gan adds.

Meanwhile, the electronics PMI is still in the red but inched up 1.6 points to 49.2 from 47.6 in July.

UOB also noted that the contraction seen in the employment index is still a matter of concern, which printed at sub-50 for the sixth straight reading. The overall employment index for the manufacturing sector contracted at a faster rate at 49.1, down from June’s 49.4.

“Singapore’s labour market is still expected to stay weak despite the introduction of Phase Two reopening on 19 June, whilst the unemployment rate is expected to rise to 3.5% with upside risk. In a nutshell, we continue to expect that hiring sentiments may continue to stay soft amid a weak labour market outlook into H2,” Gan said.

Looking ahead, the improvement in Singapore’s PMI is still encouraging, given the risks of second and third waves. However, Gan stated that further expansions will still depend on its external environment and manufacturing outlook.

Further, SIPMM highlighted that “local manufacturers remain concerned about the growth outlook due to continued uncertainties from the pandemic controls and trade disputes of the major economies”.

All-in-all, Gan added that Singapore’s economic prognosis may still stay soft in H2, given the slowdown of global demand, uncertainty over how the COVID-19 situation could evolve in the coming months, and the risk of a spike in infection in Singapore’s key trading partners which may weigh on sentiment.

Advertise

Advertise