Is Singapore headed for deflation?

Core inflation, excluding transport and accommodation costs, dropped to 0.8% in August from 1.9% in December.

Singapore is not headed for deflation despite earlier market downgrades and muted price growth that raised concern about a negative inflation forecast for end-2019, according to DBS.

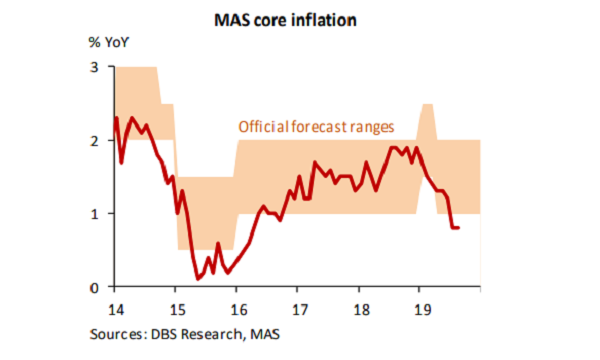

The forecast for CPI was first lowered in February to 0.5-1.5% from the earlier forecast of 1-2%. This was followed by another downward revision in April that lowered the core inflation forecast to 1-2% from 1.5-2.5% previously.

Excluding private transportation and accommodation costs, core inflation has been consistently trending downwards to 0.8% in August from 1.9% in December amidst the lower cost of electricity brought about by the nationwide launch of the Open Electricity Market.

Despite muted price growth in the past few months, inflation is likely to remain in positive territory this year. “[O]ur economist expects headline inflation to recover to 1.1% in 2020 from a projected 0.5% this year,” Philp Wee, FX strategist at DBS, said in a report.

“Overall, CPI and core inflation have averaged 0.6% YoY and 1.3% respectively in the first eight months of the year. They are likely to end the year close to the floor of their official forecast ranges,” he added.

Also read: Singapore could come off worse than regional neighbours in next global downturn

In response to subdued inflation levels, analysts have been expecting the Monetary Authority of Singapore (MAS) to ease monetary policy in an effort to prop up the slowing economy. “The fact that core inflation remains persistently below the medium-term historical average of just under 2.0% may persuade MAS to loosen monetary policy in its upcoming policy meeting,” Barnabas Gan, economist at UOB, said in an earlier note.

On his part, Wee of DBS expects MAS to slightly flatten the slope of the Nominal Effective Exchange Rate (NEER) policy band to 0.5%/year from the present pace of 1%, with the width and mid-point remaining unchanged. “We do not expect the MAS to abandon the modest and gradual appreciation path for its policy band. According to our model, the SGD NEER is still fluctuating within the stronger half of its band,” he added.

Advertise

Advertise