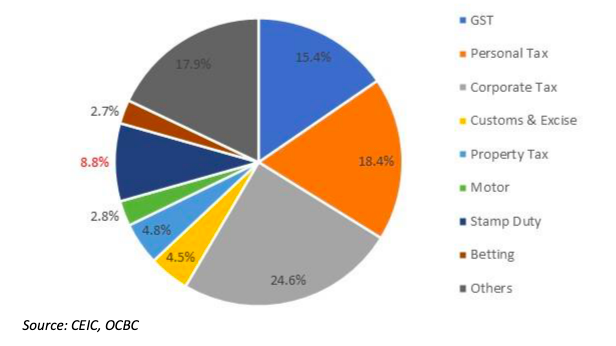

Chart of the Day: Government’s largest source of revenue in 2021

Most of these sources will undergo reform under the 2022 budget.

Corporate tax holds the crown when it comes to the government’s revenue sources, contributing 24.6% to the total collection from April to October 2021.

This is why, according to OCBC Treasury Research, the proposed reform on corporate tax rates in the 2022 budget was a “little” surprising.

Under the budget 2022, Singapore will explore a top-up tax called the Minimum Effective Tax Rate to get the effective tax rate of affected multinational corporations (MNCs) up to 15%.

Currently, Singapore's headline corporate tax rate is 17%, but the effective tax rate may be lower than the 15% threshold for some companies due to tax incentives, OCBC said.

While the reform would better align Singapore in its commitment to meet the minimum 15% tax rate set in the

global accord it signed in 2021, OCBC said it might “blunt the country’s competitiveness in attracting foreign direct investments.”

“We have consistently held the view that Singapore’s attractiveness has always lay in more than just competitive tax rates; rather, its developed infrastructure, stable political landscape, strong rule of law and a well-educated workforce play key roles in setting up Singapore as an attractive base to invest and work,” OCBC said.

“Maintaining our competitive edge on these fronts would be the best way to mitigate any disruptions brought about by the corporate tax reforms – the continued upskilling of our workforce and the digitalisation of our economy will remain key,” the analyst added.

Other sources such as personal income tax which continued 18.4% of the total revenue from April to October 2021, will also be increased for individuals with income over $500,000 per year.

Meanwhile, the GST, which contributed 15.4% in the total April-October revenue, will be raised to 8% on 1 January 2023 and then to 9% on 1 January 2024.

Advertise

Advertise