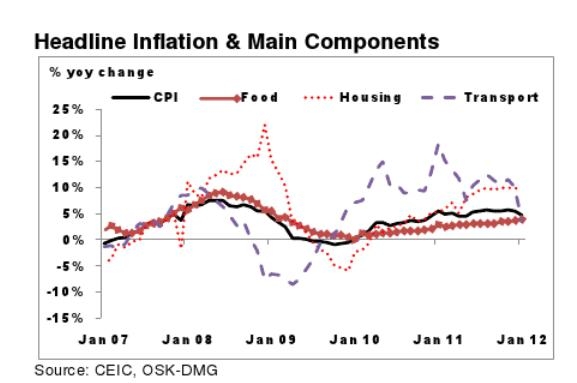

Chart of the Day: Headline Inflation and Main Components

Headline inflation in Jan fell below the 5% level, the first time in eight months.

According to OSK-DMG Economics Group, headline inflation eased in Jan rising 4.8% yoy as compared to 5.5% in Dec, helped in part by favorable base effects.

Driving headline inflation lower in Jan were more moderate yoy increases in housing and transport, which together accounts for 41% of the CPI basket.

Housing rose 9.5% in Jan yoy vs. 9.9% in Dec, while transport increased 3.5% yoy as compared to 10% in Dec. However, food prices remained elevated, up 3.8% yoy (Dec: 3.7%) as a result of the Chinese New Year holidays, said OSK-DMG. Also, recreation and others (with make up 16% of the basket) surged 3.5% in Jan from Dec’s 1.7%. Others include alcohol drinks & tobacco, personal care, household services, hobbies etc.

Core inflation as defined by MAS (which excludes accommodation and private road transport) accelerated by 3.5% in Jan, compared to 2.6% in Dec. This is the highest that core has risen since Dec 2008. According to OSK-DMG, the surge in core probably reflected the higher cost of food because of Chinese New Year and taxi fare increases as well as the higher cost of labor, which are then passed through to consumer prices. The latter suggests that core could stay persistently higher ahead as the government’s push towards greater productivity propels labor cost up, said OSK-DMG.

Advertise

Advertise