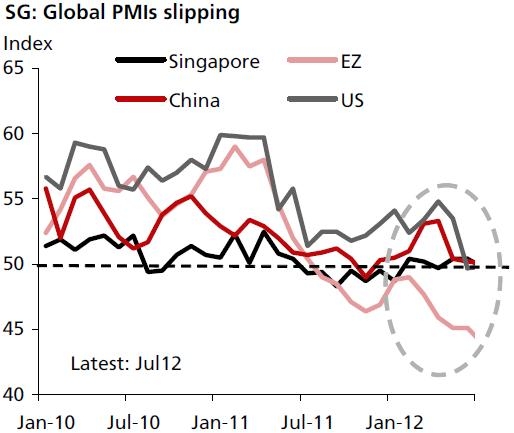

Chart of the Day: PMI contracts further

There will be spillover effects on the other segments of the economy, warns DBS.

DBS Group Research noted:

Singapore’s very own PMI as well as the PMIs of key markets have been sliding further southward into the contraction territory (<50). The SEMI book-to-bill ratio, an indicator on the health of the electronics industry has dipped to below parity level, signaling a contraction in the industry.

In short, the manufacturing sector is in for a rough patch. Not only will it affect the headline GDP figure, there will be spillover effects on the other segments of the economy, specifically the services sector.

The services sector has contracted by 0.6% QoQ saar in the second quarter, down from an expansion of 2.9% in 1Q12. Except for the transportation, inforcomm and the financial services industries, all segments within the services sector have shrunk in 2Q12. Judging from the current external economic conditions, such sluggish growth momentum will likely persist in the coming quarters.

In addition, the tightening measures on foreign labour probably have also suppressed growth momentum in some of those foreign labour-intensive industries. This is likely to be reflected in the continued poor performance by the construction sector. Developers may also be slowing down the pace of construction amid a gradual cooling down in the property market.

Advertise

Advertise