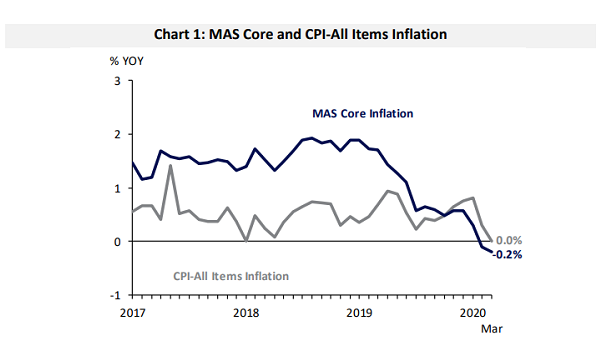

Consumer prices dipped 0.2% in March

The costs of private transport and services continue to drop.

Core inflation fell YoY to ‐0.2% in March, continuing the decline from ‐0.1% in February, as the cost of services continued to fall, according to the Monetary Authority of Singapore. Similarly, CPI‐all items inflation dipped to 0% YoY, from 0.3% in the previous month.

The drop in CPI‐all items was bland on the decline in private transport costs and cost of services.

Private transport costs reversed to -0.3% from 2.4% in February on the back of falling petrol prices, parking fees, and smaller increase in the price of cars. Lower costs for point‐to‐point transport services and telecommunication services, as well as larger declines in healthcare and holiday expenses drove the broader fall in services prices to -0.7% from -0.4% in February.

Food inflation is on the positive side at 1.5%, but lower than 1.6% in the previous month, as the prices of restaurant food and non‐cooked food recorded smaller increases. Costs for retail & other goods dipped at a slower pace on account of smaller price declines for recreational goods and medical products.

“Notably, with the recent crude oil price rout given the global supply glut and storage capacity shortfall, there could be downside risk for energy-related components in the CPI basket. The key exception could be imported food prices which may face upward pressure due to global supply chain disruptions due to the COVID-19 pandemic and the various containment measures,” said OCBC Investment Research (OIR).

The cost of electricity & gas continued to contract, despite the Open Electricity Market (OEM) having a smaller dampening effect on electricity prices due to a slowdown in new take‐up rates.

On the other hand, accommodation costs registered a larger jump to 0.5% in March from 0.4% in February as it saw a stronger pickup in housing rentals.

“One likely contributing factor could have been the implementation of the Movement Control Order (MCO) in Malaysia that led to Malaysian workers here scrambling for temporary accommodation in Singapore with the Singapore government providing $50 a day per worker for the initial two-week lockdown in Malaysia,” OIR said.

They also added that since the MCO has been extended twice until 28 April, there is also the possibility that there could be a third extension to cater for Ramadan. Hence, the housing rental inflation segment may sustain into April.

Moving forward, MAS is expecting both core inflation and CPI‐all items inflation to average between ‐1% and 0% in 2020 as COVID-19 continues to linger.

“Deflationary pressures may continue to exert in the months ahead with the one-month circuit breaker that has been extended from 4 May to 1 June,” OIR said. “The cooling of the domestic economic activities for April to May and the emergence of slack capacity, whether in manufacturing, services and construction, would necessarily imply that domestic cost pressures continue to head soft in the coming months.”

Advertise

Advertise