Photo from Shutterstock

Photo from Shutterstock

Economists mixed on MAS's next move amid stable July inflation

Inflation was unchanged at 2.5% YoY.

Economists are mixed on whether the central bank will stick to its policy or shift to easing following unchanged headline inflation in July.

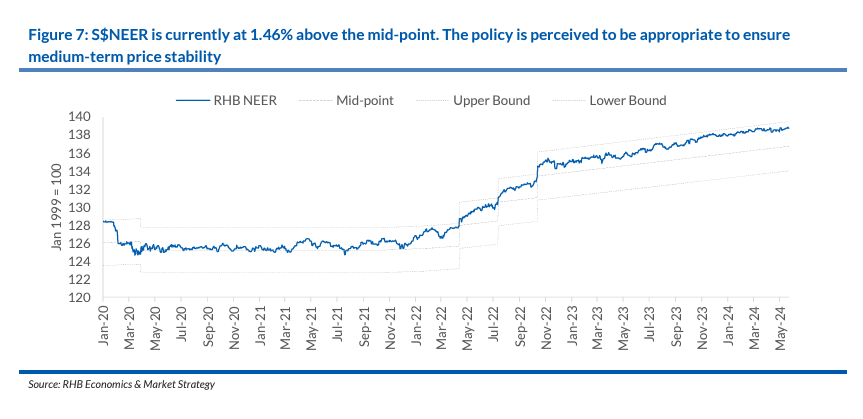

RHB experts said the Monetary Authority of Singapore (MAS) will maintain current policy parameters unchanged for the year, citing the nation's "robust economic growth and global inflation risk reduce the need for any policy adjustments."

"The prevailing rate of appreciation of the policy band will restrain imported inflation and domestic cost pressures and ensure medium-term price stability. MAS will, therefore, maintain the prevailing rate of appreciation of the S$NEER policy band," RHB said.

UOB, however, expects a policy normalisation to commence in the Oct 2024 Monetary Policy Statement through a slight S$NEER slope reduction, given the broad-based easing of the core inflation.

MAS core inflation in July eased to 2.5% YoY from 2.9% YoY in June.

UOB also projects "a meaningful step-down of core inflation to materialise only in 1Q25, driven by base effects."

For 2024, UOB expects core inflation to average 3.0% and maintained its headline inflation forecast at 2.5%.

RHB, on the other hand, has downgraded its headline inflation projection to 2.6% YoY from 3.5% YoY and maintained its full-year core inflation forecast at 2.8%.

"The downgrade of our headline inflation is based on muted inflation seen across the region and slower-than-expected inflation print on a year-to-date basis," RHB explained.

Advertise

Advertise