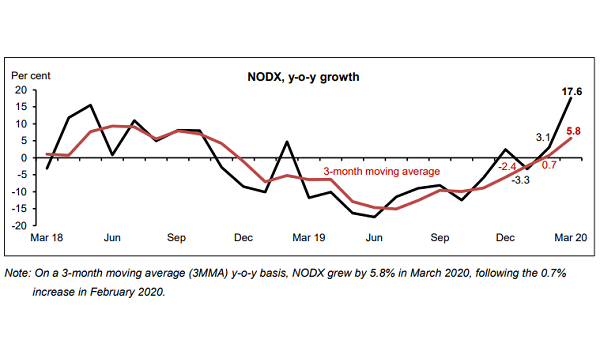

March NODX up 17.6%

It was driven by the 20.5% growth in non-electronic NODX.

NODX jumped 17.6% YoY in March as both electronic and non-electronic domestic exports increased, according to data from the Enterprise Singapore. On a MoM basis, NODX rose 12.8%.

"Nevertheless, one swallow does not make spring and does not herald that downside risks for 2Q have evaporated overnight, as illustrated by the worse-than-expected Q1 2020 GDP contraction of 6.8% YoY," OCBC Investment Research (OIR) commented.

NODX of electronic products rose 5.8% YoY in March. Disk media products, ICs and parts of ICs edged up by 50.6%, 6.7% and 60.1%, respectively. Meanwhile, non-electronic NODX expanded by 20.5% over the same period, attributed to non-monetary gold (+242.5%), specialised machinery (+54.2%) and pharmaceuticals (+48.6%).

"Non-monetary gold exports were lifted by rising gold prices due to rising risk aversion and financial market volatility, whilst the COVID-19 pandemic is driving pharmaceutical supplies and is proving to be the silver lining in the interim," OIR said.

NODX to the majority of the top markets grew in March, except Malaysia, Indonesia and China. The largest contributors were Thailand (+147.2%), the US (+22.5%) and Japan (+47.6%).

On the other hand, NORX dipped 0.9% YoY as non-electronics NORX dropped by 8.6%, despite the 8.6% growth in electronic NORX.

Total trade slipped 0.2% YoY in March 2020, after the 5.7% rise in February. Total exports declined by 0.6%, whilst imports inched up 0.3% over teh same period.

Moving forward, OIR is expecting April's NODX to contract 13.8% YoY, whilst the full-year NODX could contract of 4-6% YoY for 2020. "One interesting thing to watch would be NODX trade with China given the two-month lockdown for Hubei was lifted in late March and the Chinese government has gradually urged factories to resume production. If Chinese domestic demand snaps back in the coming months, then this could be another sliver of support for regional, especially ASEAN trade flows ahead in 2H20."

Advertise

Advertise