Payment delays ease in Q2

The retail and services sectors continue to drag prompt payments, whilst others recover.

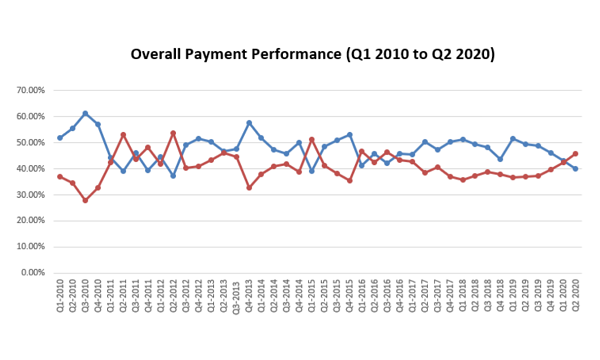

Payment performance of local firms deteriorated further in Q2, after hitting a near three-year low in Q1, according to the Singapore Commercial Credit Bureau (SCCB). Prompt and slow payments each accounted for approximately two-fifths of total payment transactions.

Prompt payments fell 3.11 percentage points (ppts) QoQ and 9.35 ppts YoY from 43.2% in Q1 to 40.09% in Q2. Slow payments likewise inched up 3.2 ppts QoQ and 8.68 ppts YoY to 45.78% in the same quarter.

Meanwhile, partial payments rose to a historical high by 3.13 ppts QoQ and 0.68 ppt YoY to 14.13% in Q2.

From a sectoral perspective, QoQ slow payments have deteriorated across two out of five industries, led by the retail and services sectors.

“The deterioration in payment performance should come as no surprise as the economy came to a virtual standstill for most of Q2. The retail and services sectors have in particular registered the highest jumps in payment delays historically. We are also seeing more partial payments in the form of staggered payment plans being made during this period,” said Audrey Chia, D&B Singapore’s CEO.

However, she noted that it is still too early to determine improvements can be seen in the near term, even with the gradual resumption of economic activities. “The cashflow situation for most firms is likely to remain tight. Hence, we would caution firms to continue exercising vigilance and prudence in their credit policies,” Chia added.

The retail sector saw a significant spike in payment delays as slow payments in the sector jumped by 9.72 ppts QoQ to 51.22% in Q2. Retailers of general merchandise saw the largest jump in slow payments, up by 18.58 ppts QoQ to 56.94%, followed by retailers of food and beverage (+17.91 ppts QoQ) at 53.17% and retailers of building materials and garden supplies (+5.05 ppts QoQ) at 55.21%.

As for the services sector, QoQ slow payments climbed 5.03 ppts to 48.35% in Q2. The engineering services subsector led in slow payments as it spiked 35.61 ppts to 49.84% over the same period.

This is followed by the educational services subsector, up by 16.95 ppts QoQ to 54.16% in Q2. The hotels and accommodation subsector saw the third highest increase in slow payments with 11.28 ppts to 45.71%.

Further, payment delays within the construction sector reversed its uptrend for two consecutive quarters in Q2 as slow payments fell by 3.93 ppts QoQ to 51.97%. The building construction sector dipped 2.17 ppts QoQ to 52.03%. Slow payments within the heavy construction sector also fell by 3.66 ppts QoQ to 51.06% in Q2, whilst payment delays within the special trade sector dropped marginally 1.50 ppts to 48.65% in Q2.

Slow payments within the manufacturing sector also slipped 4.63 ppts QoQ to 38.52% in Q2, thanks to a 4.7-ppt dip in payment delays by general manufacturers to 41.36%. This is followed by manufacturers of petroleum and coal, which saw slow payments down 2.86 ppts QoQ to 39.6%. Payment delays by manufacturers of rubber and plastic products also dropped 2.2 ppts QoQ to 37.76%.

Lastly, the wholesale trade sector’s payment delays shrunk 1.55 ppts QoQ to 38.83% in Q2, led by wholesalers of durable goods whose slow payments slipped 8.76 ppts QoQ to 38.78% in Q2, whilst payment delays by wholesalers of non-durable goods fell by 1.09 ppts QoQ to 38.9%.

Advertise

Advertise