DBS remains one of the Singapore banks employing the most people in its workforce. Globally, DBS employs an estimated 36,000 people (photo from DBS website).

DBS remains one of the Singapore banks employing the most people in its workforce. Globally, DBS employs an estimated 36,000 people (photo from DBS website).

SG banks turn to upskilling as hiring sentiments turn ‘cautious’

Roles related to wealth advisory and anti-ML and fraud are most in demand.

The number of bankers and staff employed by Singapore banks mostly remained at the same level as in 2022, although most lenders chose to incrementally hire a few more people in their headcounts.

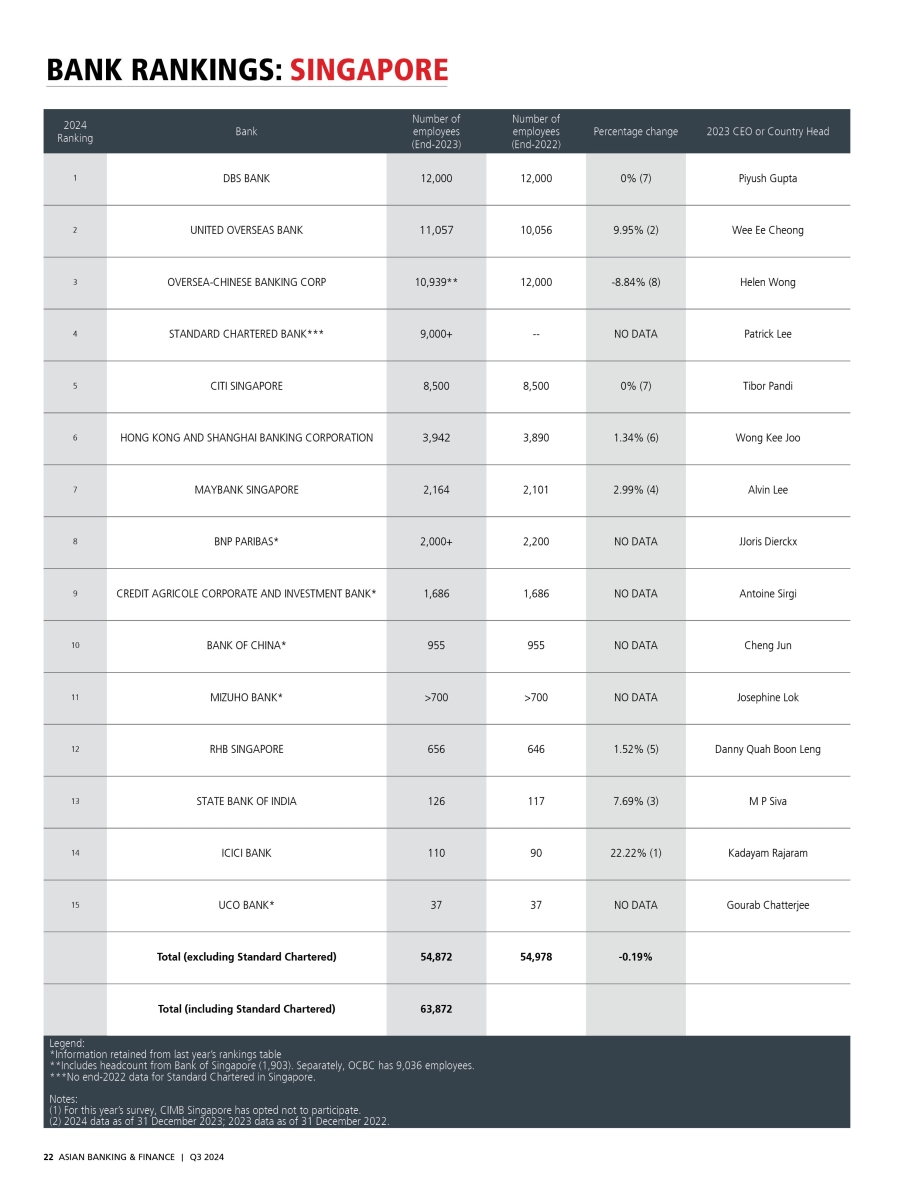

Data gathered by Asian Banking & Finance found that the number of employees working across 14 banks in the Lion City fell marginally by 0.19% to 54,872 as of end-2023. Including Standard Chartered’s workforce, there are a total of 63,872 employees across 15 banks in Singapore.

Of the “Big 3” banks, UOB recorded the highest proportion of new hires, with its headcount expanding 9.69%. UOB now employs about 11,057 people as of end-December 2023.

OCBC, including its subsidiary Bank of Singapore, trimmed its headcount to 10,939 employees.

DBS now employs over 36,000 people globally as of 2023, from just 34,000 as of December 2022. A big driver to this jump is the integration of Citi Taiwan’s 3,000 employees into DBS. As for Singapore-only numbers, DBS had around 12,000 employees in the Lion City in 2022. It did not disclose its Singapore headcount for 2023.

All other banks expanded their headcounts. RHB had 656 employees in the city, whilst HSBC had 3,942 people under its employ in 2023. The State Bank of India is larger by 9 people by the end of the year, with 126 employees in Singapore. ICICI Bank, meanwhile, ended the year with 20 more employees compared to 2022.

Apart from OCBC, the only other bank to see its headcount fall is BNP Paribas. The bank employs over 2,000 employees in 2023, a lower estimate than the approximate of 2,200 people it reportedly employed as of end-2022.

Based on estimates, Credit Agricole and Citigroup virtually recorded little to no changes in their employee numbers.

In-demand talent

When asked, most hiring heads of Singapore’s banks said that they are looking to hire roles related to wealth management and tech-related roles.

“In 2024, we will continue our strategic hiring for growth areas such as technology, wealth management and sustainability,” Ernest Phang, managing director, group human resources, OCBC, told Asian Banking & Finance via exclusive correspondence.

UOB, meanwhile, continues to hire for sales and service roles.

“We’re also expanding roles relating to Anti Money Laundering/Fraud Detection/Financial crimes and blockchain technology and AI/data analytics, as we continue growing in areas such as our anti-scam capabilities,” a UOB representative told the magazine in response to queries.

RHB Singapore casted a wider net, sharing that they are actively hiring in their corporate and investment banking, commercial banking, treasury, and retail banking businesses.

In particular, RHB Singapore’s most-in demand roles are relationship managers (RMs) and dealers, said Jenson Tng, head of human resources for the bank.

“We are prioritising the hiring and retention of front-office and middle-office employees in 2024,” Tng told Singapore Business Review. “Front-office employees, such as Relationship Managers and Dealers, are vital to driving new business opportunities and fostering strong client relationships. Middle-office employees provide critical support to our front-office teams.”

Maybank Singapore is also looking to fill front-office roles especially for its retail and corporate businesses.

“We see a demand in frontline roles for our Consumer and Corporate businesses, as well as skills in the data family as we strive to be a data-driven organisation where our decision-making and activities are centered on our areas of focus, guided by our principles of ethical banking (inclusiveness, integrity and sustainability),” said Wong Keng Fye, Maybank Singapore’s head of human capital.

HSBC Singapore’s head of HR, Mukul Anand, told Asian Banking & Finance that expanding its wealth business is also the bank’s priority in 2024.

“HSBC Singapore’s focus for 2024 continues to be on client-facing, relationship management, and customer service positions to support the demands of our growing wealth business. We also anticipate new priorities in innovation, digital products and sustainable finance across all our business lines,” Anand said.

Slowdown in hiring

All hiring managers noted a slowdown in hiring activity in the banking industry.

A UOB representative said that they were “more cautious with hiring,” citing uncertainties in the economy as well as the economic slowdown.

Both UOB and Maybank said that they pace their hiring activity to match growth expectations.

RHB Singapore’s Tng, meanwhile, noted the hiring activity slowdown in the industry as a whole, and said that their bank is “focused on targeted recruitment efforts to fill specific roles” that contribute to the bank’s transformation initiatives and create value for the bank.

Maybank’s Wong noted that the slowdown in hiring activity was unsurprising given that most banks and fintechs had significantly ramped up hiring during the pandemic.

“It is not surprising that there is a slowdown in hiring activity following the significant and accelerated hiring in the preceding period that was fuelled in part by post-COVID catch up and the proliferation of various digital [and] fintech activities, that saw organisations across many industries building up their teams,” Wong noted.

“Hence, when business [and] revenue eventually did not meet expectations, such organisations had to slow down their hiring activity, with many even having to rationalise their built-up resources,” he added, noting that Maybank “takes great care to hire right and ensure that our hiring activity matches the pace of our growth expectations.”

Turning to upskilling

More than hiring, banks in Singapore have increasingly turned to upskilling their current workforce as a growth strategy.

Both UOB and Maybank touted upskilling programmes for current employees. UOB’s development initiative Better U reskilling initiative offers specialised learning tracks on project management, data analytics, and even artificial intelligence.

“Originally focusing on 5 core competencies identified to be essential for our employees — growth mindset, problem-solving, digital awareness, human-centred design and data storytelling, this has now extended to, amongst others, effective communication, building executive presence, owning their careers, sustainability and others,” the representative said.

Maybank also has its own upskilling initiative, the FutureReady programme, aimed at helping prepare its employees for an increasingly digitised professional sphere.

Wong noted how the global pandemic’s impact has also presented an unprecedented set of circumstances, accelerating the bank’s adoption of digital tools and platforms.

“Whilst the digital transition has been greatly accelerated out of necessity, Maybank’s FutureReady push will continue to be a key focus across Maybank Group as reflected by its inclusion in the group-wide KPI and country scorecard,” Wong said.

Student support

Some banks have looked into solving the talent gap by investing in students even before they join the workforce and even in mid-career switchers looking to explore a career in finance.

HSBC’s Anand shared that the bank has programmes such as the Accelerating Wealth Programme and Polytechnic Apprenticeship Programme.

“HSBC has also signed the Employers’ Pledge for Skills Based Hiring, supported by the Infocomm Media Development Authority (IMDA), reinforcing our commitment to building a more competitive and inclusive workforce in Singapore,” Anand said.

Benjamin Teo, vice president, regional sales, global payments solutions at HSBC, was one who took part in a similar programme. Teo was a summer analyst at HSBC when he first joined the Institute of Banking & Finance’s (IBF) Finance Associate Management Scheme.

The scheme is dubbed as a “talent development initiative” by IBF and is aimed at increasing opportunities for Singaporeans and preparing them for specialist and leadership roles in the financial industry.

Under this programme, Teo joined a rotational programme spanning six departments in over two years, which then culminated in a full-time role at HSBC.

UOB, meanwhile, is the first bank in Singapore to offer a gig employment model for retired employees under the Gig+U Retiree programme, and later, the Mums@Work programme. The latter offered 200 jobs in Singapore for women who require a more flexible work schedule due to family responsibilities.

Employees hired under Gig+U receive equal pay and enjoy the same benefits as their peers with similar roles in the Bank, subject to their employment status, according to UOB.

RHB Singapore, for their part, has ongoing internship programmes with Polytechnics and universities in the Lion City.

“These internships serve as opportunities for us to groom and equip students with the necessary knowledge and skillsets to pursue successful careers in the financial industry. In fact, we still have room to welcome more students into our internship programmes,” Tng said.

--with reports from Angelica Rodulfo.

Advertise

Advertise