$883b of Asia Pacific assets ate up 26% of the global private equity market in 2018

The region's deal value rose to $165b in 2018, exceeding the all-time high of $159b in 2017.

Asia-Pacific’s private equity (PE) industry set new records in the global PE arena with $883b in total assets under management (AUM), making up 26% of the world’s PE market in 2018, according to Bain & Company’s 2019 Private Equity report.

Private equity’s share of APAC mergers and acquisitions (M&A) market rose 6 percentage points (ppt) to 17% in 2018, from the previous five-year average of 11%.

Meanwhile, APAC’s deal value rose to $165b in 2018, exceeding the all-time high of $159b recorded in 2017. Dealmaking in China and India dominated investments in the region, making up almost 75% of total deal value, the report highlighted.

Total private equity investment value in China rose to $94b in 2018, up 64% over the previous five-year average. “However, it’s important to recognize that China’s private equity market consists of two markets with very different dynamics - the market for transactions in renminbi, which is hardly accessible to nondomestic PE funds, and one in foreign currencies,” the report’s authors noted.

Internet and technology investments continued to dominate the market, making up 50% of the deal count in 2018. Meanwhile, consumption-related sectors such as healthcare and services also represented a large proportion of total PE activity, the report noted.

“As the middle class in China and India continues to expand, businesses in these sectors are growing rapidly and seeking capital. With the risk of a recession looming, demand for technology, healthcare and consumer services—sectors that tend to thrive even in a downturn—may increase in the coming year,” Bain & Company said.

Thirty-two megadeals worth $1b or more pushed the average deal size to $151m, which is on par with 2017’s numbers and up 27% over the previous five-year average of $119m. According to the report, these megadeals made up 39% of deal value, compared with an average 33% over the last five years.

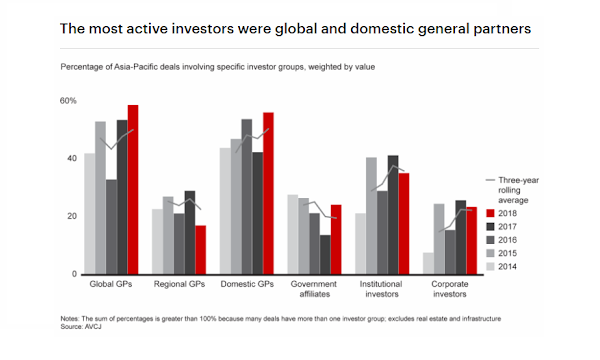

Global and domestic general partners (GPs) were found to be the most active in 2018, accounting for more than half of the deals by value. Government-linked investors also reportedly increased their momentum, representing more than a quarter of the deal value in 2018.

Investment activity in the region’s other markets was significantly higher than the 2013–17 average, except for Japan, where private equity deal value crashed 64% from the five-year average.

“Limited partners (LPs) remain keenly interested in Japan, and the volume of deals in 2018 was slightly higher than the five-year average. But in Japan, large deals can skew the numbers. Corporate divestitures make up most of the large-deal segment of $200m or more, and the number of large deals in Japan fell to three in 2018 from eight a year earlier,” the authors explained.

As a result, fewer deals caused the average deal value to drop to $67m in 2018 from $344m in 2017. The trend reportedly highlights a lack of pressure on sellers to dispose of quality assets, as Japan’s hands-on shareholders tend to focus on other actions to improve the balance sheet.

Advertise

Advertise