The biggest problem of Singapore banks during 3Q in 3 charts

Check which bank is more exposed.

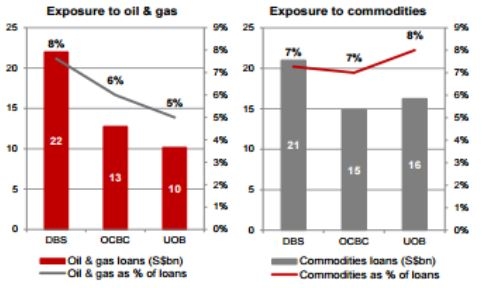

The impact of the general economic slowdown took its toll on loan demands with Singapore' Big 3 banks all reporting subdued single-digit loan growth in 3Q. But beyond weak loans, CIMB cautions that the focus this quarter was asset quality, with fears of deterioration in the banks’ oil & gas and commodities portfolios, given the commodities downcycle. There were also concerns about the banks’ exposure to Singapore mortgages and China.

Of these, CIMB notes that asset quality issues have started to appear in the downstream oil & gas portfolios, including offshore marine and oilfield support services, as some of the smaller companies in these supporting industries are starting to feel the secondary effects of lower oil prices.

Check out which bank is more exposed:

Advertise

Advertise