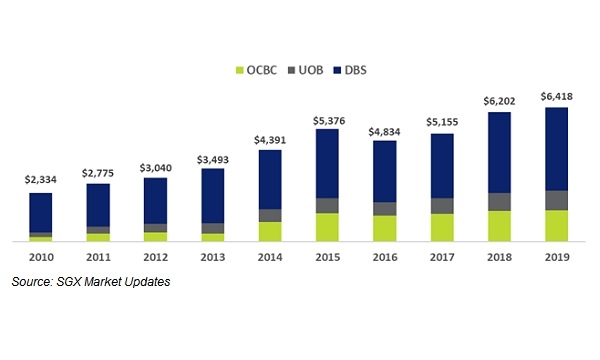

Big 3's Greater China income skyrocketed 175% over 9 years

The big three’s combined annual income for this sector amounted to $6.42b last year.

Singapore’s big three banks expanded their combined annual income from Greater China by 175% to $6.42b in 2019 from only $2.33b in 2010, according to an SGX report.

UOB, DBS, and OCBC have a combined market value of $155b and contributed $243.6m in daily turnover in the 2020 YTD, accounting for 20% of the total stock market turnover. The three banks averaged net profit growth of 10.1% in their FY19, driven by a 13.6% growth for DBS and an 8.4% growth each for both OCBC and UOB.

In regards to their Greater China income, all three reported increases for FY19, with UOB seeing the greatest increase, up 8.4%. In FY2019, Greater China total income represented 27% of DBS’ total income, a similar percentage to its contribution in FY2010.

OCBC’ and DBS’ respective Greater China businesses have also seen a gradual increase in its share of total income. OCBC’s Greater China income is at 14% as of FY2019; whilst UOB had grown its Greater China operating income to 9% in FY2019

Of the three banks, OCBC saw the biggest increase from $216m to $1.49m in its Greater China income, up sevenfold since 2010. The biggest annual increase occurred in 2014 when OCBC expanded its income by close to 150%, partly due to the acquisition of OCBC Wing Hang.

In total, the three banks have averaged 7.7% annualised total returns since 2010, noted SGX.

“Based on closing prices as of 25 February, the three banks average a 4.9% dividend yield, based on respective distributions of the past 12 months. Dividends have played an important part of the bank’s total returns since the end of 2010. Together all three stocks are amongst the 10 biggest constituents of the FTSE Developed Asia Pacific ex-Japan Sustainable Yield Index with a combined weight of 8.3% as of 31 January,” the report added.

All three banks detailed expectations and initiatives amidst the COVID-19 outbreak. DBS CEO Piyush Gupta notes that the virus will likely impact their FY2020 revenue by 1%-2% should it be controlled by summer.

OCBC’s CEO also detailed support measures, which include broad-ranging assistance for its stakeholders across Singapore, China, Hong Kong and Malaysia, noted SGX.

Finally, UOB has implemented a range of relief assistance measures for affected companies, especially small and medium-sized enterprises (SME), and mortgage relief for homeowners.

Advertise

Advertise