Local firms slack off in bills payment in Q3

Slow payments can be observed in the manufacturing, construction and services sectors.

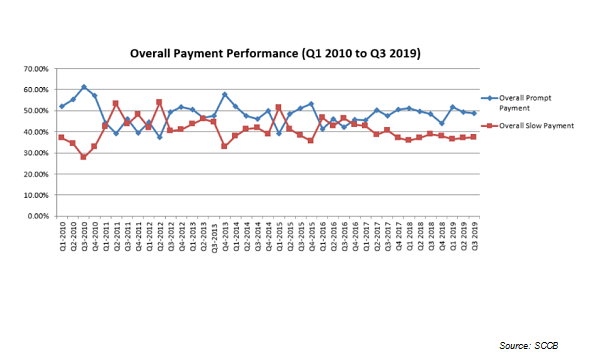

Local payment performance remained dull in Q3 as prompt payments still accounted for less than half of total payment transactions and slow payments made up for over a third of total payment transactions, according to the Singapore Commercial Credit Bureau (SCCB).

Also read: Corporate earnings take hit as economy slows

Prompt payments, which happens when 90% or more of total bills are paid within the agreed payment terms, continued to fall on a QoQ basis after dipping by 0.63 ppt from 49.44% in Q2 to 48.81% in Q3. On a YoY basis, however, prompt payments rose marginally by 0.50 ppt to 48.81% in Q3 from 48.31% in Q3 2018.

Slow payments, which refers to when less than 50% of total bills are paid within the agreed terms, rose slightly by 0.19 ppt QoQ to 37.29% in the same quarter from 37.1% in Q2 2019. On a YoY basis, it fell by 1.65 ppt from 38.94% in 2018 to 37.29% in Q3 2019.

Partial payments, which refers to when between 50% and 90% of total bills are paid within the agreed payment terms, rose by 0.46 ppt from 13.45% in Q2 to 13.91% in Q3. On a YoY basis, it rose by 1.17 ppt to 13.91% from 12.74%.

“On the overall, year-on-year payment performance has however improved. This is possibly a sign that creditors have tightened their credit limits even further in anticipation of less prompt payments,” Audrey Chia, D&B Singapore CEO said in a statement.

Also read: Nearly 7 in 10 firms' EPS declined in Q2: Credit Suisse

From a sectoral perspective, slow payments have deteriorated QoQ across three industries led by the manufacturing sector which saw the largest increase in slow payments compared to the wholesale and services industries. Slow payments in the construction sector grew by 1.14 ppt QoQ to 39.22% in Q3 from 38.08% in the previous quarter, amidst payment delays by manufacturers of leather products, printing and publishing, leather products and food products.

The services sector saw slow payments grow for the second consecutive quarter by 0.65 ppt QoQ from 35.77% in Q2 to 36.42% in Q3, attributed to payment delays within consumer services, legal and social services sub-segments. Payment delays can also be observed in wholesale trade which inched up by 0.61 ppt to 35.83% from 35.22% over the same period due to delay in payments by wholesalers of durable and non-durable goods.

The construction services recorded an unchanged slow payments rate at 46.9% in Q3, whilst the retail sector’s slow payments slipped by 1.72 ppt from 36.19% in Q2 to 34.47% amidst a decline in payment delays by retailers of general merchandise, automobiles and F&B.

D&B Singapore compiles the figures by monitoring more than 1.6 million payment transactions of firms operating through Singapore Commercial Credit Bureau (SCCB).

Advertise

Advertise