Singapore splurges $2.8b on FX fees yearly: report

The average consumer spends 15 times as much as companies in FX fees per dollar remitted.

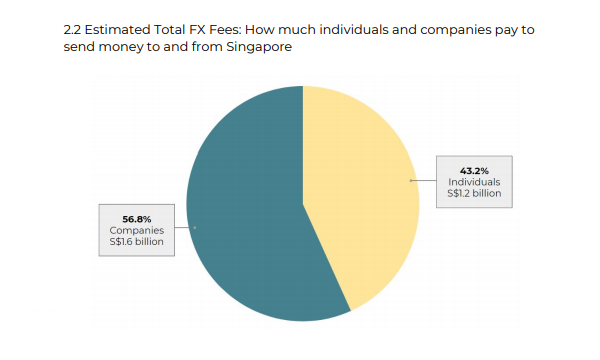

Singapore spends $2.8b in foreign exchange fees (FX) annually, a study commissioned by money transfer unicorn TransferWise revealed. The fees are paid to send $926b in total FX volume.

Households pay $2,000 on average per year. However, of the total fees, nearly $2b (71%) is hidden in exchange rate mark-ups, making it hard for individuals to know when they are being overcharged.

“The study sheds light on the disproportionate impact of FX fees on individual consumers: it is estimated they pay, on average, 15 times of what companies pay in FX fees per dollar remitted,” TransferWise said. Even though FX transactions by individuals make up 5% of the total volume of money flow, individuals pay an estimated 43% of total fees.

This issue comes on the back of Singapore's attempt to increase its share in the US$5.1t-a-day global FX market by encouraging major players to set up systems in the city that would beat or remove the sub-second delay caused by routing trades via Tokyo or London

According to the study, each Singaporean living abroad sends an average of $15,537 home a year, incurring $1,040 in fees. As the average stay of a Singaporean abroad is nearly eight years, each individual pays $8,266 in total fees during the stay.

On the whole, Singapore also pays more per capita for FX fees than Australia. Mr Kristo Käärmann, co-Founder and CEO of TransferWise, said, “When banks and remittance firms hide fees in exchange rate mark-ups, consumers don’t know how much they’re paying. This opens up an opportunity for banks to charge more than they should.”

“Individuals are charged higher fees because many are unfamiliar with the way fees are structured in a foreign exchange transaction - three in four are unaware banks and other providers mark up the exchange rate,” the study added.

The hidden fees problem is present in Singapore. TransferWise cited an example wherein to send $10,000 to the UK, one of the three local banks presents a $40 transaction fee to the customer, but actually charges $161 in total and hiding over $120 in its exchange rate mark-up.

Käärmann noted, “Telling customers how much they are being charged for a service, in dollars and cents, is the right way to do any business. If service providers don’t do this, the regulator can step in.”

Advertise

Advertise