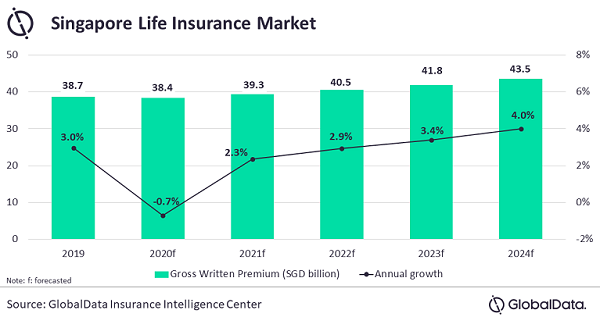

Singapore's life insurance segment to hit $43.5b in 2024

The industry crashed 13% in weighted new business premiums in H1 2020.

Singapore’s life insurance industry is poised to reach $43.5b in 2024, expanding at a compound annual growth rate (CAGR) of 2.4% between 2019 and 2024, according to data and analytics firm GlobalData.

The industry, which recorded $1.66b in weighted new business premiums during H1 2020, declined 13% compared to the same period in 2019 due to the economic slowdown caused by stringent circuit breaker and social distancing measures.

On a lighter note, the segment recovered 90.6% in weighted new business premiums in Q3 over the previous quarter, according to the data published by the Life Insurance Association (LIA).

The demand for single premium policies continues to rise, partially backed by online sales. The weighted premiums of single premium policies registered a 36% increase from January to September brought about by higher returns compared to traditional savings accounts. Furthermore, the absence of a medical underwriting process makes these policies popular.

Advertise

Advertise