Beware: this graph suggests deteriorating Singapore banks' asset quality

Something is rotten in the reported bank system's loan growth of 7% in August.

Business loan demand rebounded in Aug, lifting YTD system loan growth to 7%.

According to CIMB, the system is still flush with liquidity but the margin outlook remains weak given the stiff deposit competition on the ground.

Leading credit indicators, it said, suggest potential asset quality deterioration.

Here's more from CIMB:

Strong DBU manufacturing loans drove loan growth in Aug. Total system loans grew 1.9% mom and 7% YTD.

DBU loans advanced 2.3% mom (Jul 1.3%) and 11.5% YTD. Monthly new DBU business loans surged 84% mom in Aug, led by manufacturing loans.

DBU property-related loan growth held steady at 1.1% mom. ACU loans edged up 1.3% mom and 2% YTD.

ACU business loans inched up 1.3% mom (Jul -2%). DBU deposits rose 1.4% mom in Aug, driven by an

influx of deposits from non-bank financial institutions. System LDR ratios remained largely unchanged in Aug. The credit charge-off rate rose above its 5-year historical average for the first time since May 2010.

What We Think

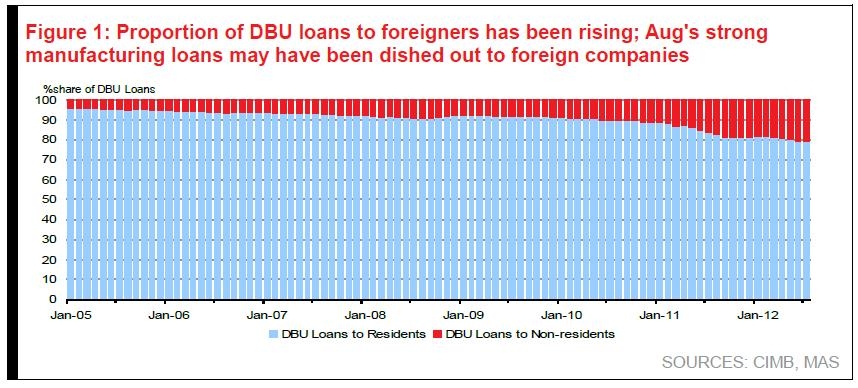

We think that the strong manufacturing loan growth could be related to foreign borrowings given the relatively low interest rates for S$. If sustained, loan growth could go to low teens, potentially exceeding local banks’ loan growth guidance.

Asset quality may deteriorate with worsening leading indicators. Credit costs could rise in the coming quarters.

Advertise

Advertise