Carousell launches e-payment system CarouPay

It is the first financial service launched in collaboration with DBS.

Singapore-grown online marketplace Carousell launched its own integrated payment system CarouPay. The feature is developed in partnership with leading financial institutions DBS, Stripe, and Visa.

According to an announcement, users can now pay through Carousell’s app using DBS PayLah!, credit, or debit cards for transactions that now reach tens of thousands every day. CarouPay will hold onto the buyer’s funds before giving them to the seller until they have received the item as expected.

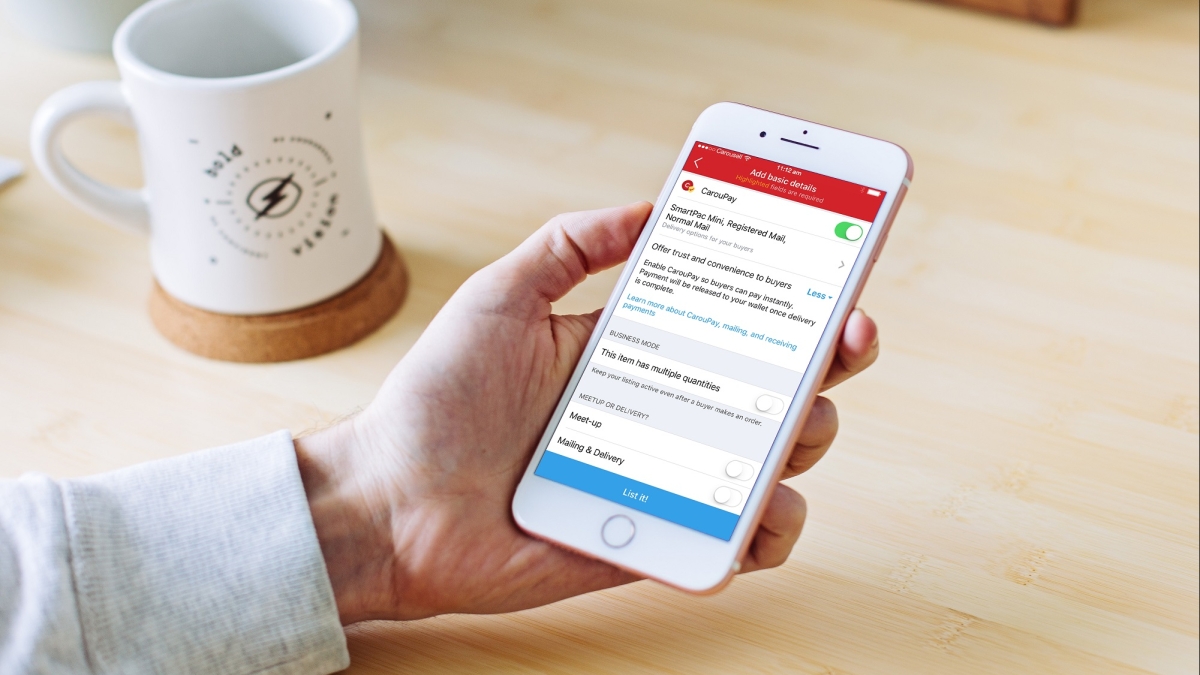

Sellers can also enable CarouPay as a payment option when listing their items. Stripe Connect will support the flow of pay-ins and pay-outs.

Once verified, sellers will be able to receive their payments from Carousell directly into their bank accounts or immediately on their Visa debit cards using Stripe's Instant Payouts feature.

“Carousellers who prefer to meet up can still continue to do so for physical inspection of items,” the company said.

Carousell added that users who do not receive their item as described or do not receive their tracked mail can raise an issue with the seller or escalate it to Carousell. Funds will be held by Carousell until a resolution is met.

For orders fulfilled via SingPost’s SmartPacs and registered mail, a live delivery status will also be available and updated in-app on Carousell so both parties can track where the item is.

From the launch of the feature until 19 July, Carousell allows users to take $5 off their first CarouPay purchase through DBS PayLah! with a minimum spend of $20. Payment fees will be waived for DBS and POSB cardholders and DBS PayLah! Users.

CarouPay is the first of the financial products and payment services that DBS and Carousell will be working on. This followed DBS’ participation in Carousell’s latest Series C fundraising round, which raised a total of US$85m from multiple investors.

Advertise

Advertise