Chart from MAS.

Chart from MAS.

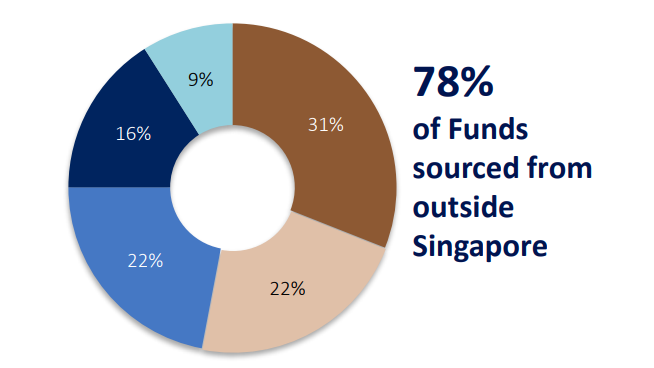

Chart of the day: APAC leads most AUM source for Singapore in 2021

The region also leads the highest total for AUM investment outside of Singapore.

This chart from the Monetary Authority of Singapore shows Singapore’s Assets Under Management (AUM) sourced from outside of Singapore and AUM of funds invested into assets outside of Singapore.

The chart shows that 78% of AUM originated from outside Singapore, and 90% of total AUM was invested in assets outside Singapore. 31% of funds sourced from outside Singapore come from Asia Pacific whilst 45% of funds invested into assets outside of Singapore also come from APAC.

Within Asia Pacific, 17% of AUM was invested in Southeast Asia.

The Singapore Asset Management Survey 2021 report provides key data on Singapore’s asset management industry for the calendar year ending 31 December 2021 and highlights key areas of development. Financial institutions surveyed include Banks, Finance and Treasury Centres, Capital Markets Services licensees (including REIT managers), Financial Advisers, Insurance Companies, Operational Headquarters and Exempt Entities, but exclude direct investments by government-related entities. 1,061 respondents participated in the survey.

Advertise

Advertise