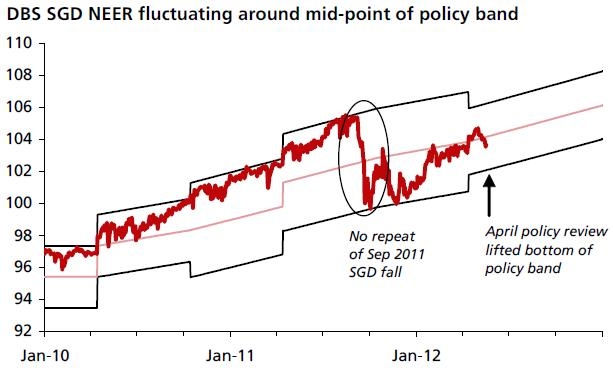

Chart of the Day: DBS SGD NEER fluctuates around mid-point of policy band

The band was narrowed to ±2% around its mid-point, and analyst says this should help to mitigate some of the downside risks to the Singapore dollar.

DBS Group Research said:

Unlike September, our in-house SGD nominal effective exchange rate (SGD NEER) was not at the strong side of its policy band, but has been fluctuating around its mid-band despite the relief rally in global markets earlier in the year from the European Central Bank’s Long Term Refinancing Operations.

Second, the Monetary Authority of Singapore (MAS) narrowed the SGD NEER policy band at its last policy review on April 13. According to our model, the band was narrowed to ±2% around its mid-point from ±3% previously. This should help to mitigate some of the downside risks to the SGD by lifting the bottom of the policy band.

In USD/SGD terms, the lower limit of the SGD NEER policy band was located at 1.2850 at yesterday’s close. Assuming that USD/SGD hits this limit today, May’s depreciation would still total only 3.7%, less than half the 7.9% in September 2011.

Even if the trade-weighted USD/SGD band heads higher for the rest of the month, it is unlikely to rise by the minimum 4.2% to beat September. Between May 1 and May 16, this upper limit for USD/SGD band was lifted by 1.3% on the back of a 4.0% fall in EUR/USD from 1.3240 to 1.2715, and an average 1.8% rise in the USD against its Asia ex Japan currency basket.

In short, a repeat of last September’s SGD depreciation will require EUR/USD to capitulate to below 1.20 towards 1.10 for the rest of May, with heavy losses for Asian currencies as well.

Advertise

Advertise