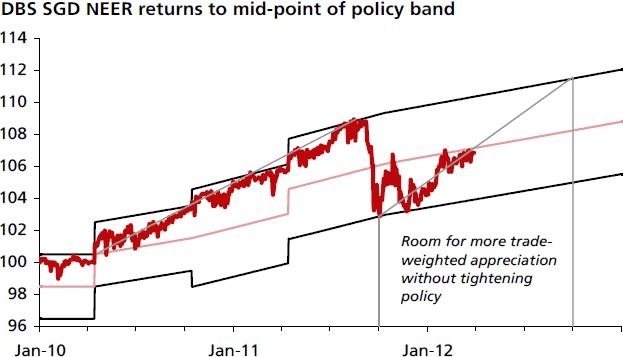

Chart of the Day: DBS SGD NEER returns to mid-point of policy band

There is scope for the SGD NEER to rise to 4-5% YoY by September, says DBS.

DBS Group Research said:

In any case, we believe that the SGD NEER policy band has been flexible to help Singapore manage the shock from last year’s European debt crisis, while balancing growth/inflation concerns.

Firstly, the ±3% wide policy band allowed the SGD to depreciate sharply and quickly last September, with the SGD NEER moving from the ceiling to floor of the policy band, to address the initial fallout in the external sector.

As non-oil domestic exports growth recovered to 30.5% YoY in February from -16.3% in October, headline inflation edged down to 4.6% YoY in February from a high of 5.7% in November. The SGD NEER, subsequently, moved back towards the mid-point to reflect a more balanced policy stance on growth and inflation.

Between now and the later policy review in October 2012, there is scope for the SGD NEER to rise to 4-5% YoY (above its 2.5-3.5% inflation outlook) by September, simply by letting the SGD NEER rise back towards its ceiling. Put simply, there is room for the authority to adopt a wait-and-see approach at the April review.

Advertise

Advertise