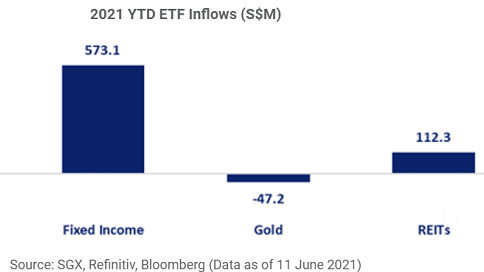

Chart of the Day: Fixed income ETFs gain bulk of inflows in H1 2021

This chart from SGX shows that Singapore’s fixed income exchange-traded funds (ETFs) have received the most inflows in the 2021 year to 11 June, with the eight ETFs seeing combined net inflows of $573.1m.

The fixed income inflows were led by the ICBC CSOP FTSE Chinese Government Bond ETF and the iShares Barclays USD Asia High Yield Bond Index ETF which received inflows of $335.5m and $152.1m, respectively.

Leading the inflows for the 18 equity ETFs, the Lion-OCBC Securities Hang Seng TECH ETF saw inflows of $150.9m, whilst the Nikko AM Singapore STI ETF saw inflows of $41m and the Xtrackers MSCI China UCITS ETF saw inflows of $14.8m.

The trio of REIT ETFs received $112.3m in inflows, with the Nikko AM-Straits Trading Asia ex Japan REIT ETF recipient to $82.4m in inflows.

ETF inflows generally come from primary market creation of ETF units by the participating dealers to meet the excess demand from institutional and retail investors for the ETFs on the secondary market. Outflows, on the other hand, result from primary market redemption due to selling activities of institutional and retail investors in the market.

Advertise

Advertise