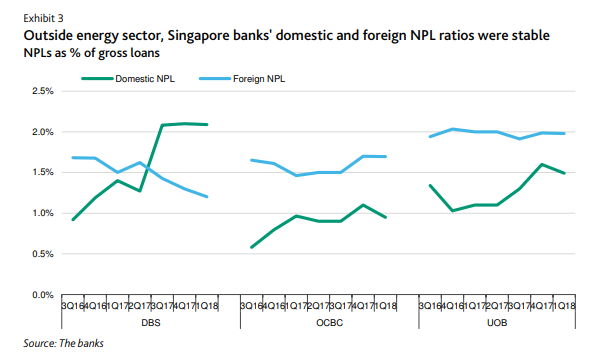

Chart of the Day: OCBC and UOB's domestic bad loans dipped in Q1

Moody's said this could boost their asset performance in the coming quarters.

This chart from Moody's Investors Service shows that, for the first quarter of 2018, both OCBC and UOB reported lower domestic nonperforming loans (NPL) outside the energy sector. Nonperforming loans refer to borrowed money that has not been paid beyond the deadline for at least 90 days.

OCBC's domestic NPLs as a percentage of gross loans below 1%, whilst those of UOB's hit 1.5%. DBS' domestic NPLs percentage, on the other hand, barely moved from last quarter at 2.1%.

OCBC and UOB's foreign NPLs were stable. For DBS, the situation was the opposite, because of larger recoveries and write-offs in the foreign book.

Moody's VP-senior analyst Simon Chen commented, "Healthy economic growth in Singapore and falling NPL ratios in other ASEAN economies are likely to continue to support the three banks' asset performance in coming quarters."

The three banks' nonperforming loan (NPL) ratios declined on lower net NPL formation, in particular from oil and gas exposures.

Advertise

Advertise