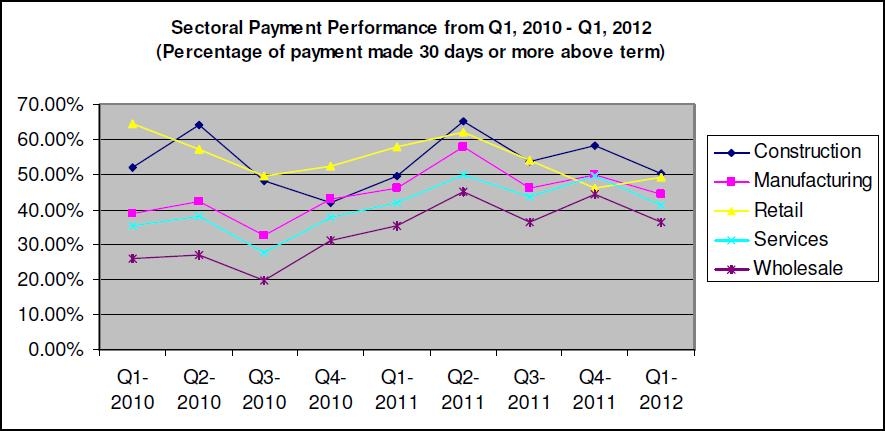

Chart of the Day: Services sector post largest dip in slow payments

Overall slow payment in the services sector saw a sharp decline due to healthy growth in the food, accommodation and tourism-related services.

Dun & Bradstreet Singapore reported:

A sectoral breakdown of slow payments showed marked improvements across most industry verticals, with the services sector registering the largest dip in slow payments. Buoyed by healthy growth in the food, accommodation and tourism-related services, overall slow payment in the services sector saw a sharp decline by 8.3 percentage points to 41.3 per cent. The drop in slow payments is also attributable to a surge in trading activities in the financial, insurance and business services sectors.

Meanwhile, payment delays in the construction sector fell by 7.9 percentage points, registering 50.4 per cent due to an increase in construction activities in residential and institutional building segments.

The manufacturing sector also took a healthy upturn, fuelled by increased production across all clusters, notably electronics and precision engineering. Slow payment for the manufacturing sector declined by 5.5 percentage points to a 12-month low of 44.5 per cent.

Despite slowing global trade flows and weaker external demand, the wholesale trade sector has maintained the lowest payment delays, down by 7.8 percentage points from the preceding quarter, to 36.4 per cent.

After posting a strong rebound in the last quarter, the retail trade sector saw negative changes in payment performance, largely due to the continued deterioration of domestic economic activity. Slow payments rose slightly to 49.1 per cent, up by 2.9 percentage-points from the preceding quarter.

However, the improved payment performance in the first quarter is hardly indicative of a future upward trend as local payment performance has been volatile and unpredictable over the past twelve months.

Advertise

Advertise