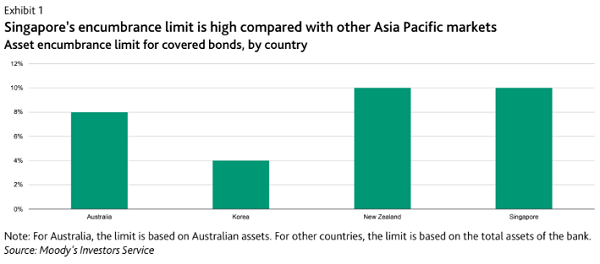

Chart of the Day: Singapore has high encumbrance limits vs. other APAC markets

A high limit would cut refinancing risks if banks would ease issuance.

This chart from Moody’s Investors Service shows that Singapore’s encumbrance limit is high compared with other Asia Pacific markets. A high limit would slash refinancing risk if banks would lift issuance, the report said.

In October, the Monetary Authority of Singapore (MAS) raised the asset encumbrance limit for covered bonds, which will allow banks to increase covered bonds issuance. Under the new encumbrance limit, the value of assets in the cover pools of covered bonds that banks issue cannot exceed 10% of banks’ total assets, up from 4% previously.

This means banks can issue a higher volume of covered bonds relative to their total assets than in previous cases.

For covered bonds, a deeper market with greater issuance and a broader pool of market participants cuts refinancing risks, because if an issuer defaults there will likely be more potential buyers for the failed issuer’s cover pool. The greater number of potential buyers will reduce the discount on cover pool value if the issuer defaults.

Advertise

Advertise