Chart of the Day: Total stock buyback consideration hits $15.1m in August

STEngg and Keppel led the buyback consideration.

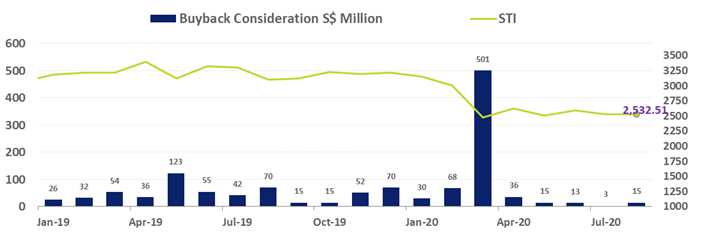

This chart from the Singapore Exchange (SGX) shows that the total share buyback consideration for August reached $15.1m, higher than $2.9m consideration in July and the $12.6m in June.

However, this was considerable lower than the $70m buyback consideration reported in August 2019.

STI constituents Singapore Technologies Engineering (STEngg) and Keppel Corporation led the buyback consideration in August. As many as 11 companies commenced new mandates, which included Keppel, AEM Holdings, First Resources and Straco Corporation.

The $15.1m August buyback consideration coincided with a 0.1% price gain in the Straits Times Index (STI) to 2,532.51, the narrowest monthly price move by the STI since March 2019. Dividend distributions boost the STI total return in August to 1.1%

Overall, total consideration of share buybacks for SGX primary-listed stocks has now reached $681m for the first eight months of 2020, up from $590m in consideration for the entire calendar year of 2019.

Advertise

Advertise