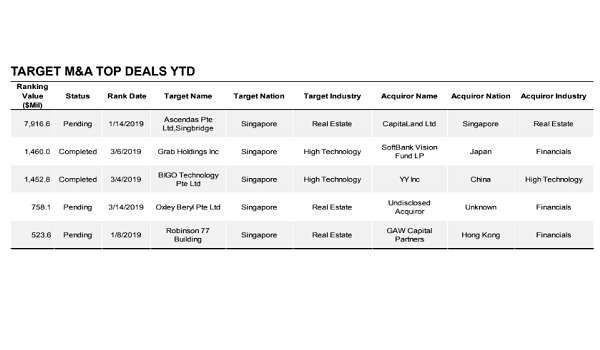

Chart of the Day: What are the top targeted M&A deals in Q1?

CapitaLand's US$7.9b acquisition of Ascendas is the largest M&A so far in SEA.

Singapore-targeted M&A deals skyrocketed 240.4% YoY to rack US$15.8b in proceeds and marking the highest Q1 haul on record, according to data from Refinitiv.

Also read: M&A activity fell 30.7% to $90.86b in 2018

The strong quarterly figures was bolstered by CapitaLand’s US$7.9b pending acquisition of Ascendas Pte Ltd, which is currently the largest Southeast Asian M&A deal so far this year and also the largest domestic Singaporean deal on record.

This was followed by SoftBank Vision Fund's US$1.46b funding into Grab and China's YY Inc's US$1.45b funding into BIGO Technology.

Overall Singapore announced M&A activity hit US$24.2b so far this year, making it the strongest start for Singapore-involvement M&A since 2014.

JP Morgan leads the M&A league table rankings in Q1, with 33% market share and US$7.9b in related deal value. HSBC Holdings follows in second place with 6.7% market share, whilst China Renaissance Securities (HK) and Lazard are tied for the third spot each with 6% market share.

Advertise

Advertise