CPFIS funds record 4.44% average returns in Q4 2019

Equity funds saw the biggest increase in returns at 5.99%.

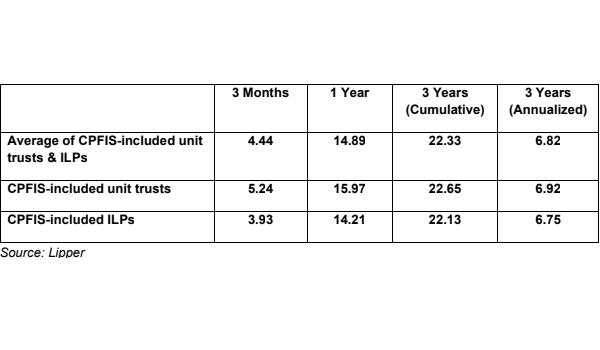

The overall Q4 2019 performance of funds under the Central Provident Fund Investment Scheme (CPFIS) posted positive returns of 4.44% on average, according to financial markets data provider Refinitiv.

Positive average returns of 5.24% and 3.93% were recorded amongst CPFIS-included unit

trusts and CPFIS-included investment-linked insurance policies (ILPs), respectively. All asset types saw positive average returns, with equity funds seeing the biggest jump of 5.99%, whilst bond funds recorded average returns of 0.1%.

CPFIS-included funds grew 14.89% on average, with CPFIS-included unit trusts and CPFIS-included ILPs up 15.97% and 14.21% respectively for a one-year period. For the three-year period, CPFIS-included funds achieved 22.33% growth, accounted for a gain of 22.65% from CPFIS-included unit trusts and 22.13% from CPFIS-included ILPs.

Advertise

Advertise