Credit searches by local firms down 24.06% in 2019

This is the first contraction seen following seven consecutive years of growth.

Overseas credit searches by local businesses crashed 24.06% in 2019, according to a Singapore Commercial Credit Bureau (SCCB) report. This comes on the back of merchandise trade and NODX falling 3.2% and 9.2%, respectively.

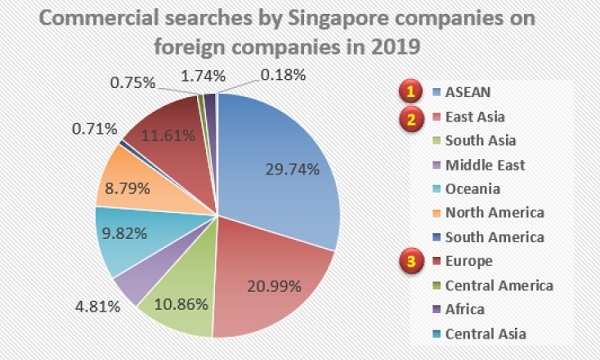

This is said to be the first contraction seen following seven consecutive years of increase. The decline was led by credit searches in Europe, which dipped from 12.94% in 2018 to 11.61% in 2019. Despite this the UK, Germany and Switzerland remain the top three most searched European countries by Singaporean firms.

Credit searches on East Asian companies also fell to 20.99% in 2019 from 26.91% in 2018, where China, Hong Kong and Japan were the most searched countries within the region.

On the other hand, the proportion of credit searches made on ASEAN companies inched up to 29.74% in 2019 from 27.7% in 2018. Malaysia, Indonesia and Vietnam recorded the most credit searches within ASEAN by local firms, which are also Singapore’s top ASEAN trading partners.

Meanwhile, credit searches made by foreign companies on local firms slipped 11.25%, which marked the first decline since 2014. Europe registered the highest proportion of credit searches done on Singapore companies, followed by North America and East Asia.

However, credit searches by European companies still posted a decline of 36.2% in 2019 from 39.47% in 2018, where the United Kingdom, Germany and Netherlands have remained as the top European countries accounting for the highest proportion of searches done on Singapore firms.

Credit searches by North American companies came second as it increased marginally from 23.54% in 2018 to 23.73% in 2019. East Asian companies registered the third highest proportion of credit searches, sliding 12.85% from 15.43% over the same period. Japan, Hong Kong and the Republic of Korea saw the highest number of searches on Singapore firms.

“The credit quality of Singapore firms has taken a turn for the worse over the past year given the macroeconomic headwinds, heightened growth risks and volatilities. Whilst the financial strength of firms has experienced a slight deterioration, the more worrying trend is the increase in proportion of firms with higher risk standing.” said SCCB’s CEO Audrey Chia.

Furthermore, the overall risk standing of local firms has deteriorated. The proportion of firms that experienced a fall in risk standing has jumped from 21.36% in 2018 to 22.18% in 2019.

The proportion of firms seeing improvements in risk standing has remained almost flat, inching up slightly from 16.12% in 2018 to 16.56% in 2019.

Firms that posted an improvement in financial standing slipped to 23.15% in 2019 from 24.13% in 2018, whilst those which saw a deterioration rose to 12.31% in 2019 from 12.11% in 2018.

Advertise

Advertise