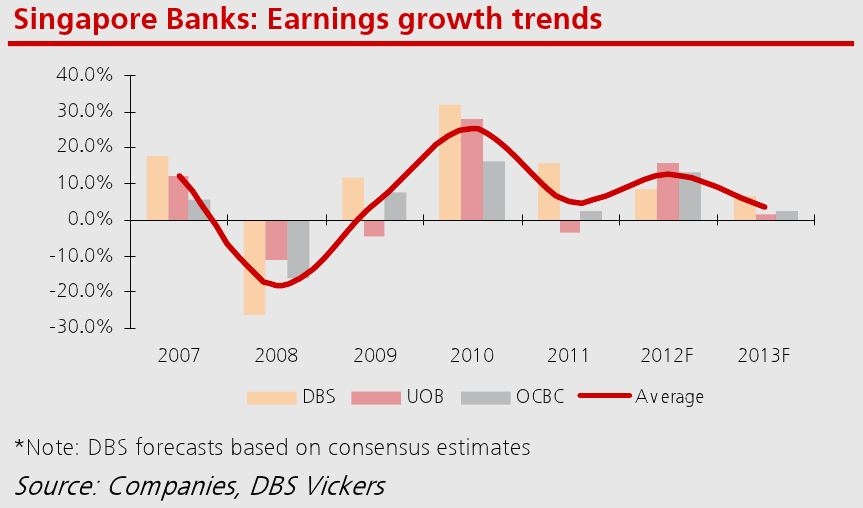

This graph strikingly shows banks are going to take a deep dive

Weak momentum is here to stay.

According to DBS Vickers, although a technical recession was averted, momentum is weak.

Here's more from DBS Vickers:

Based on our correlation analysis where loan growth lags GDP growth by 4-6 quarters, loan growth is likely to moderate further in 2013.

We have also imputed slower mortgage loan growth arising from the recent property cooling measures. Hence, this leads us to cut FY13-14F loan growth to 8% (from 10%).

We raised credit charge-off rates by 2-4bps to 31-32bps on macro weakness and the strong loan growth the banks had booked over the past 6 quarters.

We trimmed NIM down by 3-11bps over the same period on the back of NIM pressure persisting and SIBOR unlikely to hike till 2015. Our previous positive stance on NIM was premised on NIM bottoming in 2012 and SIBOR rising in 2014

Advertise

Advertise