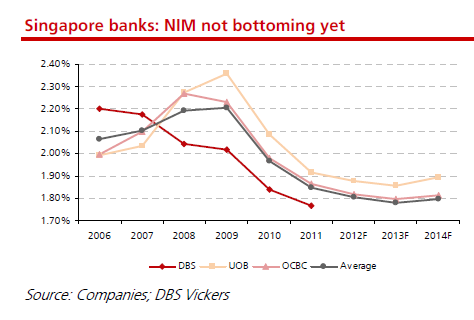

Hope fades for banks recovering by 2013

Net interest margin seen to slip over the next 2-3 quarters before stabilising.

According to DBS, NIM is unlikely to bottom yet. For 2013, stable NIM rather than hope for a recovery would be the game plan.

"Banks appear to be optimising their funding profile while tackling pressures with asset/loan yields. The window to price up loans has closed; if any, corporate loans can only be priced up selectively and it would not be sufficient to offset NIM compression," it said.

"Furthermore, SIBOR is not expected to inch up till mid-2015. Assuming deposit cost eases off over time while competition remains, NIM would at best inch up a little by then," it added.

DBS notes that banks could compromise a little in NIM but this must be compensated by fee income. Loan growth, it said, should remain in the single-digit territory but upside is possible should macro drivers turn positive earlier than expected.

Advertise

Advertise